Rice Corporation is negotiating a loan for expansion purposes and the bank requires financial statements. Beforeclosing the

Question:

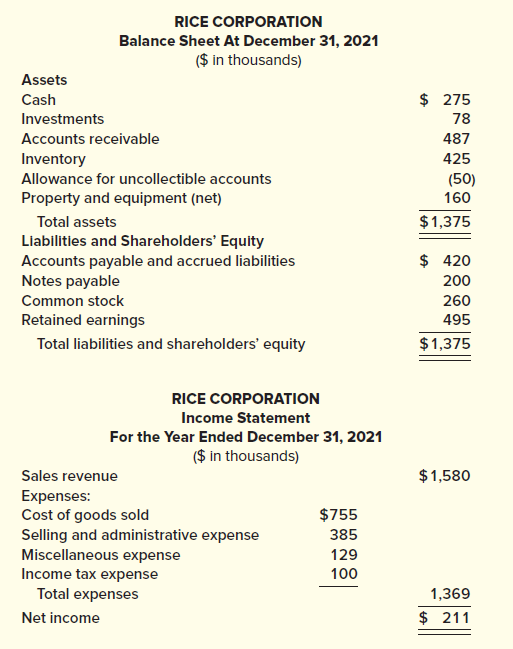

Rice Corporation is negotiating a loan for expansion purposes and the bank requires financial statements. Beforeclosing the accounting records for the year ended December 31, 2021, Rice?s controller prepared the followingfinancial statements:

Additional Information:1. The company?s common stock is traded on an organized stock exchange.2. The investment portfolio consists of short-term investments valued at $57,000. The remaining investmentswill not be sold until the year 2023.3. Notes payable consist of two notes: Note 1: $80,000 face value dated September 30, 2021. Principal and interestat 10% are due on September 30, 2022.Note 2: $120,000 face value dated April 30, 2021. Principal is due in two equal installments of $60,000 plusinterest on the unpaid balance. The two payments are scheduled for April 30, 2022, and April 30, 2023.Interest on both loans has been correctly accrued and is included in accrued liabilities on the balance sheetand selling and administrative expense in the income statement.4. Selling and administrative expense includes $90,000 representing costs incurred by the company in restructuringsome of its operations. The amount is material.Required:Identify and explain the deficiencies in the presentation of the statements prepared by the company?s controller.Do not prepare corrected statements. Include in your answer a list of items that require additional disclosure, eitheron the face of the statement or in a note.

Face ValueFace value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas