Romer Corporation began operations on January 1, 2015. The company decided to lease all plant assets rather

Question:

Romer Corporation began operations on January 1, 2015. The company decided to lease all plant assets rather than purchase them. Romer used the operating method for all leased assets in 2015 and 2016. On January 1, 2017. a new accountant joined the company and determined that the assets should be accounted for as finance leases following U.S. GAAP. Assume that this is a correction of an error. Income before tax and lease-related expenses in 2015, 2016, and 2017 are $580,()00, $600,000, and $720,000, respectively.

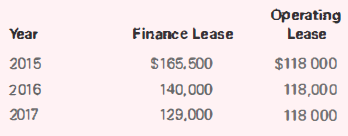

The tax rate is 40%. Lease-related expenses under the two methods for low:

Required

a. Determine the amount of the prior-period adjustment in the year of the correction.

b. Prepare partial comparative income statements for the years ended December 31, 2015 through 2017.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella