The beginning balance in the Machinery control account and Accumulated Depreciation account, and dates in the accounts

Question:

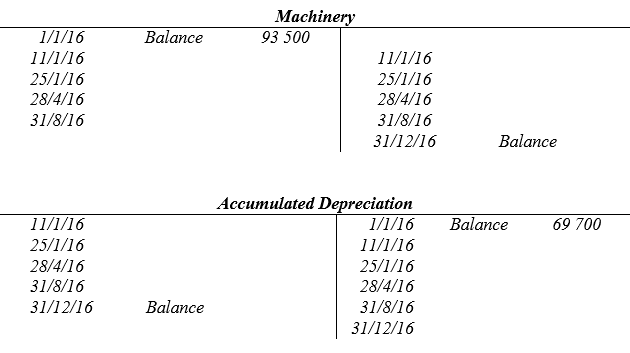

The beginning balance in the Machinery control account and Accumulated Depreciation account, and dates in the accounts for various machinery acquisitions and disposals during the year by Liu Ltd are presented below:

Liu Ltd records depreciation to the nearest month.

At 1 January 2016, the company held only four items of machinery, and four exchange trans-actions took place during 2016 as indicated below:

Jan. Jan. April Aug. | 11 25 28 31 | Exchanged an old machine and $13000 cash for a similar machine (No. P) with a list price of $16000. The old machine had a cost of $10000 and accumulated depreciation of $7000 at the time of the exchange. An old machine with a cost of $24000 and accumulated depreciation at 31 December 2015 of $19200 was traded in on a new machine (No. Q) having a cash price of $36000. Depreciation on the old machine for the month of January was $800. A trade-in allowance of $3000 was received and the balance was paid in cash. A machine with an original cost of $54000 and accumulated depreciation on 31 December 2015 of $40000 was exchanged for a new machine (No. R) with a cash price of $75000. A trade-in allowance of $10000 was received and the balance paid in cash. Monthly depreciation on the old machine was $500. A machine with a cost of $5500 and a carrying amount at the date of the exchange of $1600 was traded in on a new machine (No. S) with a list price of $7000. A trade-in allowance of $2000 was received and $5000 was paid in cash. The old machine has been depreciated at $50 per month during 2016. |

At the dates of acquisition, the useful lives and residual values of the new machines were as follows:

Machine no. | Useful life | Residual value | ||||

P Q R S | 4 years 5 years 10 years 3 years | $2000 6000 15000 1500 | ||||

Straight-line depreciation is used by the entity.

Required

A. Prepare in Liu Ltd’s accounting records the journal entries (in general journal format) to record the acquisition, disposal and depreciation charges for the period 1 January to 31 December 2016.

B. Prepare the Accumulated Depreciation account for the period 1 January 2016 to 31 December 2016.

C. Provide reasons, by referring to appropriate accounting standards, for an entity adopting the straight-line method for depreciating its machinery.

Step by Step Answer:

Accounting

ISBN: 978-1118608227

9th edition

Authors: Lew Edwards, John Medlin, Keryn Chalmers, Andreas Hellmann, Claire Beattie, Jodie Maxfield, John Hoggett