Question: The CFO of First Things Computing, Inc. (FTC) prepared the following net income statement for the year ended December 31, 2023. FTC had 15,000 common

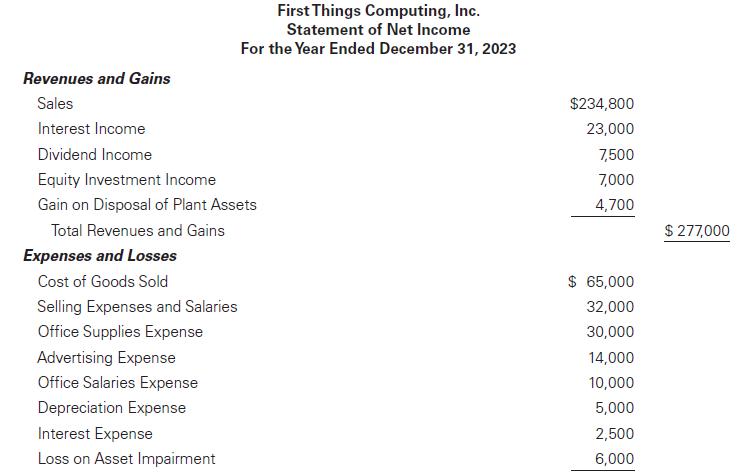

The CFO of First Things Computing, Inc. (FTC) prepared the following net income statement for the year ended December 31, 2023.

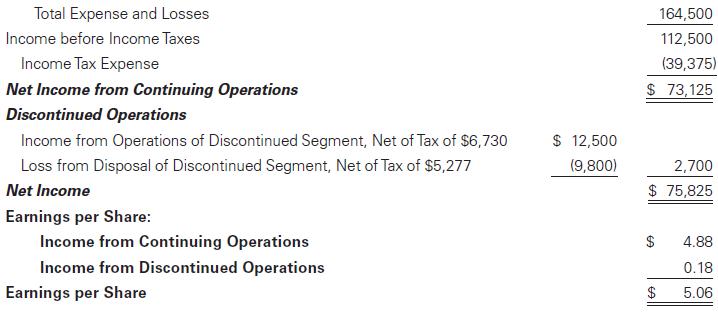

FTC had 15,000 common shares outstanding for the entire year. It had no preferred stock or dilutive securities. Thus, its earnings per share (EPS) is computed simply as earnings divided by shares outstanding. According to the current statement of net income, its EPS is $5.06 ($75,825 net income divided by 15,000 shares). FTC records income tax expense at 35% of income from continuing operations before income taxes.

The CFO will make the following adjustments before finalizing the financial statements:

1. FTC will need to record some amount of bad debt expense. The offset will be a reduction in accounts receivable. This adjustment is a matter of judgment and reasonable estimates range between $1,000 and $3,000.

2. FTC will need to write down its inventory (i.e., reduce the reported value of inventory). The offset will be to cost of goods sold. This adjustment is a matter of judgment and reasonable estimates range between $2,500 and $3,750.

3. FTC may need to record an impairment of property, plant, and equipment (PPE) (i.e., reduce the reported value of PPE). The offset will be an impairment loss reported on the statement of net income. This adjustment is a matter of judgment and reasonable estimates range between $0 and $5,000.

4. FTC may need to record an impairment of noncurrent investments (i.e., reduce the reported value of noncurrent investments). The offset will be an impairment loss reported on the statement of net income. This adjustment is a matter of judgment and reasonable estimates range between $250 and $750.

5. FTC may need to record a litigation contingency (i.e., it may need to record a liability for an unresolved lawsuit). The offset is to litigation expense. The lawsuit is expected to be settled in 2024. FTC’s attorneys believe that they can provide a point estimate of the amount for which FTC will be liable. The estimate will either be $2,000 or $10,000.

6. FTC may need to reduce the reported amount of its deferred tax asset. The amount by which the asset needs to be reduced is highly judgmental and ranges from $0 to $5,000. The offset to this adjustment is income tax expense. (Thus, this adjustment impacts post-tax net income, but no pre-tax net income).

7. FTC currently has unearned revenue on its balance sheet of $5,400. However, up to $5,000 of this amount could possibly be recognized as revenue in 2023. However, this amount is a matter of judgment.

Required

a. If FTC makes the most conservative choices for all these adjustments resulting in the lowest income number, what is the impact on net income and earnings per share?

b. If FTC makes the least conservative choices for all these adjustments by making the choices that will result in the highest income number, what is the impact on net income and earnings per share?

c. Do you think that the management of FTC will care very much about the choices related to these adjustments? Why or why not?

Revenues and Gains Sales Interest Income Dividend Income Equity Investment Income Gain on Disposal of Plant Assets Total Revenues and Gains Expenses and Losses Cost of Goods Sold Selling Expenses and Salaries Office Supplies Expense Advertising Expense Office Salaries Expense Depreciation Expense First Things Computing, Inc. Statement of Net Income For the Year Ended December 31, 2023 Interest Expense Loss on Asset Impairment $234,800 23,000 7,500 7,000 4,700 $ 65,000 32,000 30,000 14,000 10,000 5,000 2,500 6,000 $ 277,000

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

a If FTC makes the most conservative choices for all the adjustments we need to consider the adjustments that result in the lowest income number 1Bad debt expense Assuming the most conservative estima... View full answer

Get step-by-step solutions from verified subject matter experts