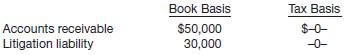

Question: The differences between the book basis and tax basis of the assets and liabilities of Castle Corporation at the end of 2013 are presented below.

The differences between the book basis and tax basis of the assets and liabilities of Castle Corporation at the end of 2013 are presented below.

It is estimated that the litigation liability will be settled in 2014. The difference in accounts receivable will result in taxable amounts of $30,000 in 2014 and $20,000 in 2015. The company has taxable income of $350,000 in 2013 and is expected to have taxable income in each of the following 2 years. Its enacted tax rate is 34% for all years. This is the company’s first year of operations. The operating cycle of the business is 2 years.

Instructions

(a) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2013.

(b) Indicate how deferred income taxes will be reported on the balance sheet at the end of 2013.

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

a Debit Income Tax Expense for 49000 30000 20000 x 34 Credit Deferred Income Taxes for 49000 Credit ... View full answer

Get step-by-step solutions from verified subject matter experts