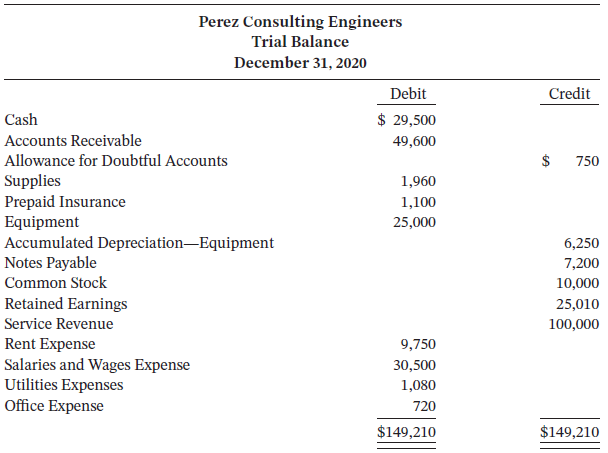

The following are the trial balance and the other information related to Perez Consulting Engineers. 1. Fees

Question:

The following are the trial balance and the other information related to Perez Consulting Engineers.

1. Fees received in advance from clients $6,000, which were recorded as revenue.

2. Services performed for clients that were not recorded by December 31, $4,900.

3. Bad debt expense for the year is $1,430.

4. Insurance expired during the year $480.

5. Equipment is being depreciated at 10% per year.

6. Perez gave the bank a 90-day, 10% note for $7,200 on December 1, 2020.

7. Rent of the building is $750 per month. The rent for 2020 has been paid, as has that for January 2021, and recorded as Rent Expense.

8. Office salaries and wages earned but unpaid December 31, 2020, $2,510. Instructions

a. From the trial balance and other information given, prepare annual adjusting entries as of December 31, 2020. (Omit explanations.)

b. Prepare an income statement for 2020, a retained earnings statement, and a classified balance sheet. Perez paid a $17,000 cash dividend during the year (recorded in Retained Earnings).

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel