The inventory of Oheto Company on December 31, 2020, consists of the following items. Instructions a. Determine

Question:

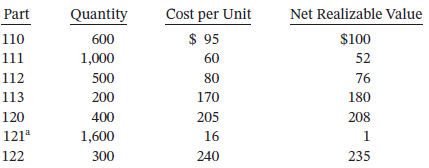

The inventory of Oheto Company on December 31, 2020, consists of the following items.

Instructions

a. Determine the inventory as of December 31, 2020, by the LCNRV method, applying this method to each item.

b. Determine the inventory by the LCNRV method, applying the method to the total of the inventory.

Transcribed Image Text:

Cost per Unit $ 95 60 80 170 Net Realizable Value Quantity 600 Part 110 $100 52 111 112 1,000 500 200 76 113 180 208 120 121* 122 205 16 240 400 1,600 300 235

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (20 reviews)

a 335100 b 341300 Part No 110 111 112 113 120 121 122 Totals Quantity ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Question Posted:

Students also viewed these Business questions

-

Lower-of-Cost-or-Market The inventory of Oheto Company on December 31, 2011, consists of the following items. (a) Determine the inventory as of December 31, 2011, by the lower-of-cost-or-market...

-

The inventory of Oheto Company on December 31, 2019, consists of the following items. Part No. 121 is obsolete and has a realizable value of $1 each as scrap. Instructions a. Determine the inventory...

-

The inventory of Wei Company on December 31, 2014, consists of the following items. aPart No. 21 is obsolete and has a realizable value of $0.20 each as scrap. Instructions (a) Determine the...

-

Avid Corporation manufactures a sophisticated controller that is compatible with a variety of gaming consoles. Excluding rework costs, the cost of manufacturing one controller is $ 220. This consists...

-

Compare and contrast DNA replication in bacteria and eukaryotes.

-

Workers in large workplaces (with over 1,000 workers at one location) get paid more than they do in smaller work places. If workers are similar in skill and quality, why might an employer with a...

-

Claire Fitch is planning to begin an individual retirement program in which she will invest $1,500 at the end of each year. Fitch plans to retire after making 30 annual investments in the program...

-

An investor considers investing $10,000 in the stock market. He believes that the probability is 0.30 that the economy will improve, 0.40 that it will stay the same, and 0.30 that it will...

-

Exercise 15-19 (Algorithmic) (LO. 3, 4) Henry, a freelance driver, finds customers using various platforms such as Uber and Grubhub. He is single and has no other sources of income. In 2019, Henry's...

-

A company generally purchases large lots of a certain kind of electronic device. A method is used that rejects a lot if two or more defective units are found in a random sample of 100 units. (a) What...

-

Kumar Inc. uses LIFO inventory costing. At January 1, 2020, inventory was $214,000 at both cost and market value. At December 31, 2020, the inventory was $286,000 at cost and $265,000 at market...

-

Referring to the situation in P9.2 for Garcia Home Improvement Company, consider the following expanded data at May 31, 2020. Assume Garcia uses LIFO inventory costing. Instructions a. 1. Determine...

-

Describe the alterations from the standard report when a scope limitation has occurred and the auditors have issued a qualified opinion.

-

A release has been planned with 5 sprints. The team, for the sake of convenience, has decided to keep the sprint duration open. Depending on how much they commit and achieve, they decide to wrap up...

-

Task 3: Reach-truck management 3 Explain why battery-powered reach truck activities at PAPFS are unsatisfactory. Note: You should support your answer, where applicable, using relevant information...

-

Exercise 6: Black Pearl, Inc., sells a single product. The company's most recent income statement is given below. Sales $50,000 Less variable expenses Contribution margin Less fixed expenses Net...

-

Your maths problem x+3x-3

-

Spencer is a 10-year-old boy who has been living in a family-style therapeutic group home for one year. He was removed from his mother's care due to neglect from her drug use and the resulting legal...

-

a. A radioactive isotope emits only -particles. i. Draw a labelled diagram of the apparatus you would use to prove that no -particles or -radiation are emitted from the isotope. ii. Describe the test...

-

Consider a game of poker being played with a standard 52-card deck (four suits, each of which has 13 different denominations of cards). At a certain point in the game, six cards have been exposed. Of...

-

Explain the iGAAP reporting guidelines for items recognized in comprehensive income but that do not affect net income.

-

Presented below are three different transactions related to materiality. Explain whether you would classify these transactions as material. (a) Blair Co. has reported a positive trend in earnings...

-

Brett Favre Repair Shop (a sole proprietorship) had the following transactions during the first month of business. Journalize the transactions. (Omit explanations.) Aug. 2 Invested $12,000 cash and...

-

explain in excel please For a particular product the price per unit is $6. Calculate Revenue if sales in current period is 200 units. Conduct a data analysis, on revenue by changing the number of...

-

Hall Company sells merchandise with a one-year warranty. In the current year, sales consist of 35,000 units. It is estimated that warranty repairs will average $10 per unit sold and 30% of the...

-

Q 4- Crane Corporation, an amusement park, is considering a capital investment in a new exhibit. The exhibit would cost $ 167,270 and have an estimated useful life of 7 years. It can be sold for $...

Study smarter with the SolutionInn App