The long-term liabilities section of CPS Transportation?s December 31, 2020, balance sheet included the following:a. A lease

Question:

The long-term liabilities section of CPS Transportation?s December 31, 2020, balance sheet included the following:a. A lease liability with 15 remaining lease payments of $10,000 each, due annually on January 1:

Lease liability ..........................$ 76,061Less: Current portion .................2,394.................................................$ 73,667

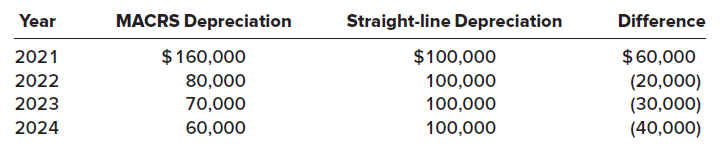

The incremental borrowing rate at the inception of the lease was 11% and the lessor?s implicit rate, which was known by CPS Transportation, was 10%.b. A deferred income tax liability due to a single temporary difference. The only difference between CPS Transportation?s taxable income and pretax accounting income is depreciation on a machine acquired on January 1, 2020, for $500,000. The machine?s estimated useful life is five years, with no salvage value. Depreciation is computed using the straight-line method for financial reporting purposes and the MACRS method for tax purposes. Depreciation expense for tax and financial reporting purposes for 2021 through 2024 is as follows:

The enacted federal income tax rates are 20% for 2020 and 25% for 2021 through 2024. CPS had a deferred tax liability of $7,500 as of December 31, 2020. For the year ended December 31, 2021, CPS?s income before income taxes was $900,000.On July 1, 2021, CPS Transportation issued $800,000 of 9% bonds. The bonds mature in 20 years, and interest is payable each January 1 and July 1. The bonds were issued at a price to yield the investors 10%. CPS records interest at the effective interest rate.

Required:1. Determine CPS Transportation?s income tax expense and net income for the year ended December 31, 2021.2. Determine CPS Transportation?s interest expense for the year ended December 31, 2021.3. Prepare the long-term liabilities section of CPS Transportation?s December 31, 2021, balance sheet.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas