The Outsider Company, Inc, provided the following information regarding its inventory for the year ended December 31,

Question:

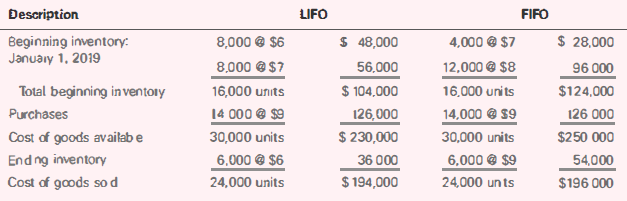

The Outsider Company, Inc, provided the following information regarding its inventory for the year ended December 31, 2019. It made all of the purchase, before it had any sales transactions for the year.

Required

a. Compute the LIFO reserve at the beginning of the year (i.e., at December 31, 2018).

b. Compute the LIFO reserve at the end of the year (i.e., at December 31, 2019).

c. Illustrate how the firm can use the LIFO reserve to convert ending inventory from the LIFO to the FIFO basis for both years (i.e., 2018 and 2019).

d. Illustrate how the firm can use the LIFO reserve to convert the LIFO cost of goods sold to the FIFO cost of goods sold for 2019.

e. Describe the conditions that indicate that there is a LIFO liquidation for 2019.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella