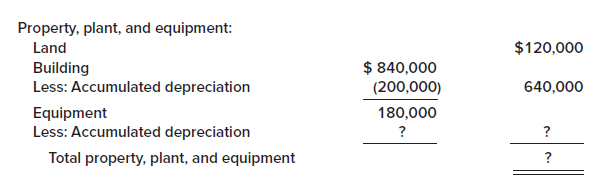

The property, plant, and equipment section of the Jasper Company?s December 31, 2020, balance sheet contained the

Question:

The property, plant, and equipment section of the Jasper Company?s December 31, 2020, balance sheet contained the following:

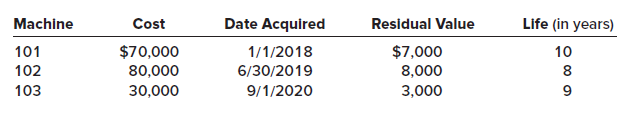

The land and building were purchased at the beginning of 2016. Straight-line depreciation is used and a residual value of $40,000 for the building is anticipated.The equipment is comprised of the following three machines:

The straight-line method is used to determine depreciation on the equipment. On March 31, 2021, Machine 102 was sold for $52,500. Early in 2021, the useful life of machine 101 was revised to seven years in total, and the residual value was revised to zero.

Required:1. Calculate the accumulated depreciation on the equipment at December 31, 2020.2. Prepare the journal entry to record 2021 depreciation on machine 102 up to the date of sale.3. Prepare a schedule to calculate the gain or loss on the sale of machine 102.4. Prepare the journal entry for the sale of machine 102.5. Prepare the 2021 year-end journal entries to record depreciation on the building and remaining equipment.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas