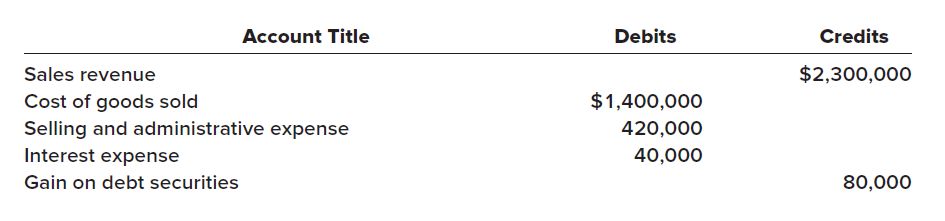

The trial balance for Lindor Corporation, a manufacturing company, for the year ended December 31, 2021, included the following accounts: The gain on debt securities

The trial balance for Lindor Corporation, a manufacturing company, for the year ended December 31, 2021, included the following accounts:

The gain on debt securities is unrealized and classified as other comprehensive income. The trial balance does not include the accrual for income taxes. Lindor?s income tax rate is 25%. There were 1,000,000 shares of common stock outstanding throughout 2021.

Required:Prepare a single, continuous multiple-step statement of comprehensive income for 2021, including appropriate EPS disclosures.

Credits Debits Account Title $2,300,000 Sales revenue Cost of goods sold Selling and administrative expense Interest expense Gain on debt securities $1,400,000 420,000 40,000 80,000

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

lindor CORPORATION Statement of Comprehensive Income ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards