[This is a variation of E 9-2, modified to focus on the lower of cost or market.]

Question:

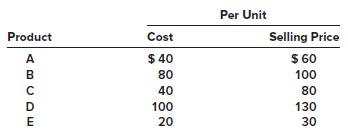

[This is a variation of E 9-2, modified to focus on the lower of cost or market.] The inventory of Royal Decking consisted of five products. Information about the December 31, 2021, inventory is as follows:

Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal profit is 30% of selling price.

Required:

What unit value should Royal Decking use for each of its products when applying the lower of cost or market (LCM) rule to units of ending inventory?

E 9-2

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Question Posted: