Times-Roman Publishing Company reports the following amounts in its first three years of operation: The difference between

Question:

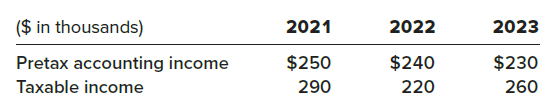

Times-Roman Publishing Company reports the following amounts in its first three years of operation:

The difference between pretax accounting income and taxable income is due to subscription revenue for one-year magazine subscriptions being reported for tax purposes in the year received, but reported in the income statement in later years when the performance obligation is satisfied. The income tax rate is 25% each year. Times-Roman anticipates profitable operations in the future.

Required:1. What is the balance sheet account that gives rise to a temporary difference in this situation?2. For each year, indicate the cumulative amount of the temporary difference at year-end.3. Determine the balance in the related deferred tax account at the end of each year. Is it a deferred tax asset or a deferred tax liability?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas