Welsh, Inc. began operations January 1, 2021. During 2023, management changed its method of accounting for inventories

Question:

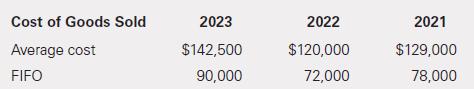

Welsh, Inc. began operations January 1, 2021. During 2023, management changed its method of accounting for inventories from the average-cost method to the first-in, first-out (FIFO) method. This change is effective as of January 1, 2023. If cost of goods sold had been determined under each of these two methods for all years of operation, the results would have been:

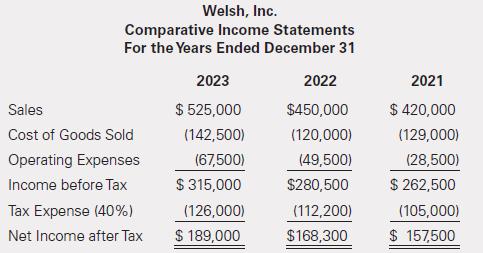

The company’s income statements as reported under average cost before implementing the accounting change for 2023, 2022, and 2021 follow. The income tax rate for Welsh is 40%. Welsh will continue to use average cost for income tax reporting.

Required

a. Prepare the comparative income statements for Welsh after the change to FIFO.

b. Determine the after-tax cumulative effect in the retained earnings balance for the first balance sheet presented (i.e., at December 31, 2022). Welsh presents comparative balance sheets.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella