Question: You are employed by McDowell and Partners, Chartered Accountants (M&P). A new client, Community Finance Corporation (CFC), approached M&P for assistance. Enviro Ltd. (Enviro) has

You are employed by McDowell and Partners, Chartered Accountants (M&P). A new client, Community Finance Corporation (CFC), approached M&P for assistance. Enviro Ltd. (Enviro) has asked CFC for a loan of $10 million in the form of long-term debt to fund capital expenditures and other operating requirements. CFC has already conducted a general assessment of Enviro but now needs an accounting firm to look closely at the financial aspects, including the areas of financial risk. In particular, CFC needs to be assured that it will receive the payments of principal and interest over the term of the loan. M&P has accepted the engagement and is responsible for preparing a report to CFC.

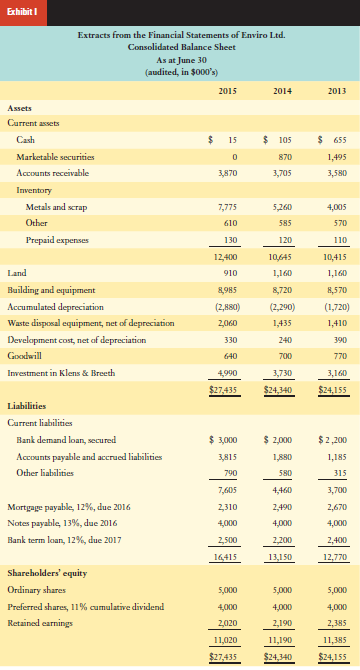

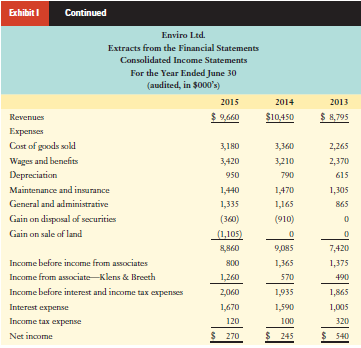

It is now August 2015. Enviro€™s board of directors have provided both CFC and M&P with recent financial statements (Exhibit I) and extracts from the working papers of Enviro€™s auditors, Y&Z, for the most recent year-end (Exhibit II). The engagement partner wants you to prepare a memo addressing CFC€™s concerns.

Required:

Prepare the memo requested by the engagement partner.

Exhibit II

Extracts from Y&Z€™s Working Papers

For the Year Ended June 30, 2015

Enviro

1. Enviro is a holding company that was incorporated under federal legislation several years ago as an investment company for a small group of investors. Enviro owns the following:

- 100% of the voting shares of Waste Disposal Corporation (WDC), which collects and disposes of environmentally hazardous chemicals.

- 50% of a partnership that specializes in designing advertisements for organizations that promote improvements to the environment. The partnership is called Klens & Breeth (KB). KB in turn owns all the voting shares of two corporations involved in advertising design and development.

- 100% of the voting shares of Scrap Metal Enterprises Ltd. (SMEL), which deals in the collection and sale of non-precious metals (copper, iron, and others).

2. Enviro€™s existing bank loans are secured by a first charge on receivables. The mortgage payable is secured by a first mortgage on the land and building. The notes payable are secured by inventory and are due in August 2016. The notes payable cannot be renewed because payment in full has been demanded.

3. Enviro is insured for liability and accidents but not for theft and fire.

4. Enviro paid dividends on preferred shares of $440,000 in each of 2013, 2014, and 2015. In addition, the company paid $100,000 of dividends on common shares in 2013.

Exhibit II

WDC

1. To meet government requirements, WDC€™s disposal equipment has to be upgraded by October 1, 2016; otherwise, large segments of the operations will have to be suspended and other safe disposal methods will have to be found€”an unlikely prospect. Upgrading is really the only. alternative if WDC is to avoid having to cancel contracts and incur significant cancellation penalties. Approximately $7 million is needed as soon as possible.

2. Using its own waste disposal technology, WDC builds some of the equipment that it needs to process certain wastes. During fiscal 2015, the following expenditures were capitalized:

Components and parts ........................................................... $322,100

Wages and benefits ................................................................ 208,220

Overhead costs ........................................................................ 208,000

Interest on borrowings ........................................................... 12,680

$751,000

The overhead costs are allocated based on roughly 100% of wages and benefits.

KB

1. We do not audit KB but have reviewed the audit working papers and have had discussions with KB€™s auditors. KB€™s income for the year ended March 31, 2015, was $2,520,000, and Enviro has appropriately accounted for its share using the equity method of accounting. Enviro is a silent partner. However, Enviro provides major assistance in developing new client contracts for KB. The other partner needs the partnership form of ownership for various purposes. Among the more significant transactions during fiscal 2015 were the following:

a. KB accounts for its investments on an equity basis; its subsidiaries paid cash dividends in fiscal 2015 of $1,200,000. KB retained these funds to develop new technology.

b. KB earned $1,875,000 from a federal government contract that has expired this month. Most of the fee was recognized in income in 2015 because the ideas had already been generated for another project and few additional costs were necessary.

c. The other partner of KB operates an advertising fi rm for non-environmental promotion. KB paid this firm $895,000 for a variety of services.

SMEL

1. SMEL€™s scrap metal piles are large, and it is difficult to estimate the quantity of metal in the piles. To satisfy ourselves, we photographed the piles, compared them geometrically to photographs of previous years, and discussed important issues with management. We also conducted extra checks of the perpetual inventory system against arrival and departure weights of rucks. The system was operating satisfactorily, but estimates were necessary for wastage.

2. The scrap metal is recorded at cost because resale prices of scrap vary considerably. If prices are low, SMEL stores the metals until selling prices improve. Management believes there is no need to sell at a loss.

3. The government requires a soil test of SMEL€™s scrap yard every five years. The most recent soil test was conducted four years ago.

Exhibit I Extracts from the Financial Statements of Enviro Ltd. Consolidated Balance Sheet As at June 30 (audited, in $000's) 2015 2014 2013 Assets Current assets $ 105 24 $ 655 Cash 15 Marketable securities 870 1,495 Accounts receivable 3,870 3,705 3,580 Inventory Metals and scrap 7,775 5,260 4,005 Other 610 585 570 Prepaid expenses 130 120 110 10,645 12,400 10,415 Land 1,160 1,160 910 Building and equipment 8,985 8,720 8,570 Accumulated depreciation (2,290) (2,880) (1,720) Waste disposal equipment, net of depreciation 2,060 1,435 1,410 Development cost, net of depreciation 330 240 390 Goodwill 640 700 770 Investment in Klens & Breeth 4,990 3,730 3,160 $27,435 $24,340 $24,155 Liabilities Current liabilities $ 3,000 $ 2,000 $2,200 Bank demand loan, secured Accounts payable and accrued liabilities 3,815 1,880 1,185 Other liabilities 790 580 315 7,605 4,460 3,700 Mortgage payable, 12%, due 2016 2,310 2,490 2,670 Notes payable, 13%, due 2016 4,000 4,000 4,000 Bank term loan, 12%, due 2017 2,500 2,200 2,400 16,415 13,1 50 12,770 Shareholders' equity Ordinary shares 5,000 5,000 5,000 Preferred shares, 11% cumulative dividend 4,000 4,000 4,000 Retained earnings 2,020 2,190 2,385 11,020 11,190 11,385 $27,435 $24,155 $24.340 Exhibit I Continued Enviro Ltd. Extracts from the Financial Statements Consolidated Income Statements For the Year Ended June 30 (audited, in $000's) 2015 2014 2013 $ 9,660 $10,450 $ 8,795 Revenues Expenses Cost of gexds sokd 3,180 3,360 2,265 Wages and benefits 3,420 3,210 2,370 Depreciation 950 790 615 Maintenance and insurance 1,440 1,470 1,305 General and administrative 1,335 1,165 865 Gain on disposal of securities (340) (910) Gain on sale af land (1,105) 8,860 9,085 7,420 Income before income from associates 800 1,365 1,375 Income from associate Klens & Breeth Income before interest and income tax expenses 1,260 2,060 570 490 1,935 1,865 Interest expense 1,670 1,590 1,005 Income tax expense 120 100 320 Net income $ 270 $ 245 $ 540

Step by Step Solution

3.31 Rating (172 Votes )

There are 3 Steps involved in it

To Engagement Partner McDowell and Partners Chartered Accountants From Your Name Date Current Date Subject Financial Assessment of Enviro Ltd for CFC ... View full answer

Get step-by-step solutions from verified subject matter experts