You have been tasked with analyzing the leases of Delta Air Lines. In Delta Air Lines lease

Question:

You have been tasked with analyzing the leases of Delta Air Lines. In Delta Air Lines’ lease disclosures, its lease obligations on its finance leases were $821 million, whereas the lease obligations on its operating leases were $5,294 million, over six times as high. Use Delta Air Lines’ lease disclosures presented below to answer the following questions.

a. What is the journal entry to reflect scheduled payments during 2020 for finance leases in place at the end of 2019?

b. Using the information from part a.), estimate the company’s average interest rate on finance leases. Compare this rate to the company’s weighted average discount rate on its finance leases presented in its note disclosures.

c. What is the journal entry to reflect the amortization expense on property and equipment under finance leases in 2020?

d. What is the journal entry to reflect scheduled payments during 2020 for operating leases in place at the end of 2019?

e. If the company’s operating leases were treated as finance leases, what would be the total expenses related to the leases in 2020? By what percentage would the total expenses related to the lease expense increase? What would be the difference in net income before taxes?

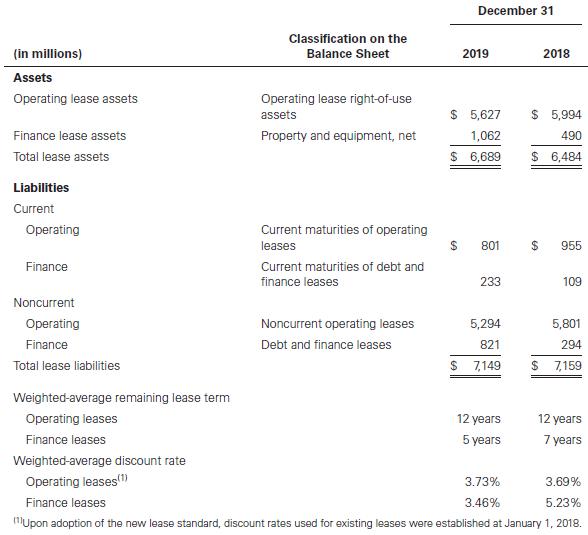

Lease Disclosure, Delta Air Lines Inc. Financial Statements, December 31, 2019Note 8: Leases (excerpt)Lease PositionThe table below presents the lease-related assets and liabilities recorded on the balance sheet.

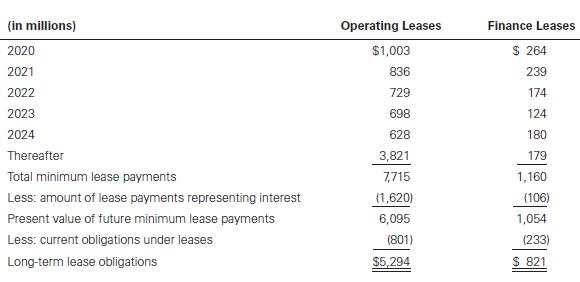

Undiscounted Cash FlowsThe table below reconciles the undiscounted cash flows for each of the first five years and total of the remaining years to the finance lease liabilities and operating lease liabilities recorded on the balance sheet.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella