Question: Your assignment is to analyze Pfizers Inc. operating cash flows and compare it to that of Johnson & Johnson. Use Pfizers statement of cash flows

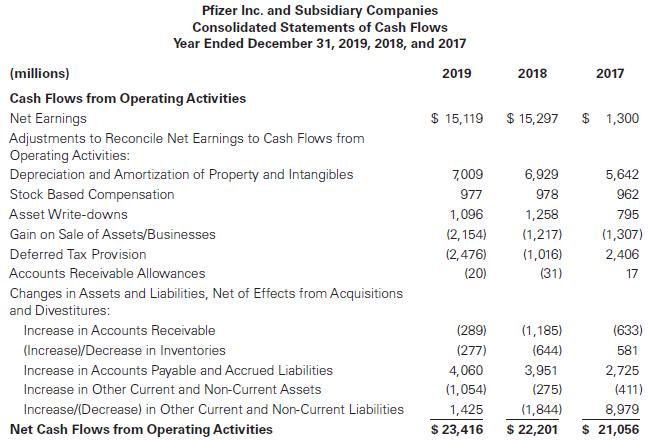

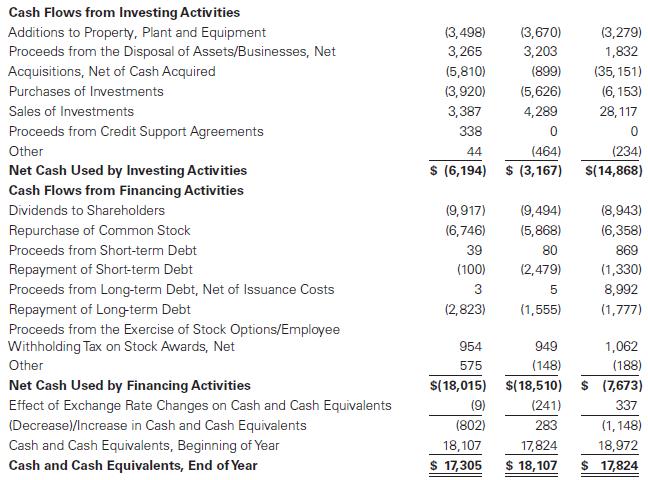

Your assignment is to analyze Pfizer’s Inc. operating cash flows and compare it to that of Johnson & Johnson. Use Pfizer’s statement of cash flows and the following information to address these questions:

a. What is Pfizer’s net cash provided by operating activities each year? What was the change and percentage of change in Pfizer’s net cash provided by operating activities each year? Compare the changes in net cash provided by operating activities to the changes in net income.

b. What are Pfizer’s major adjustments for noncash expenses and losses? What are the major adjustments for noncash revenues and gains?

c. For each year, compute and comment on the following cash coverage ratios for Pfizer:

• Short-term debt coverage

• Debt coverage

• Dividend coverage

• Sales coverage

• OCF to income ratio

d. For each year, compute and comment on Pfizer’s free cash flows. Compare its free cash flows to its operating cash flows.

e. Using Johnson & Johnson’s information from Example 22.16 in the text, compare Pfizer and Johnson & Johnson’s cash coverage ratios and free cash flows.

Additional Information

For the Year-Ended or at the Year-End (in millions)

Data from Example 22.16

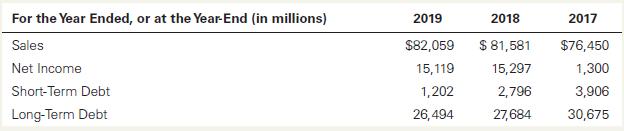

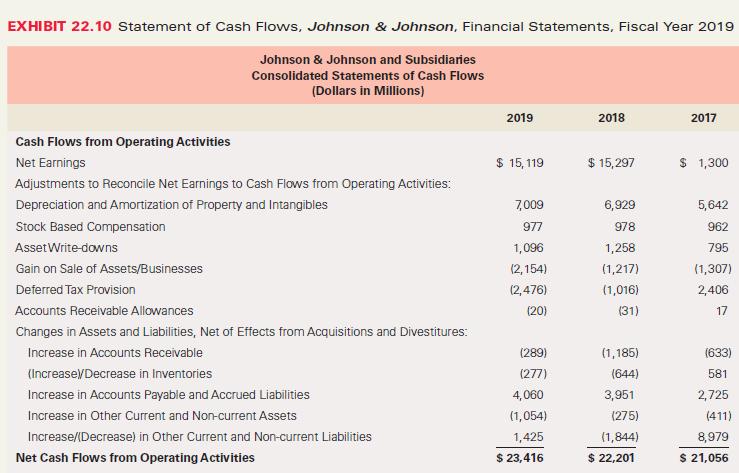

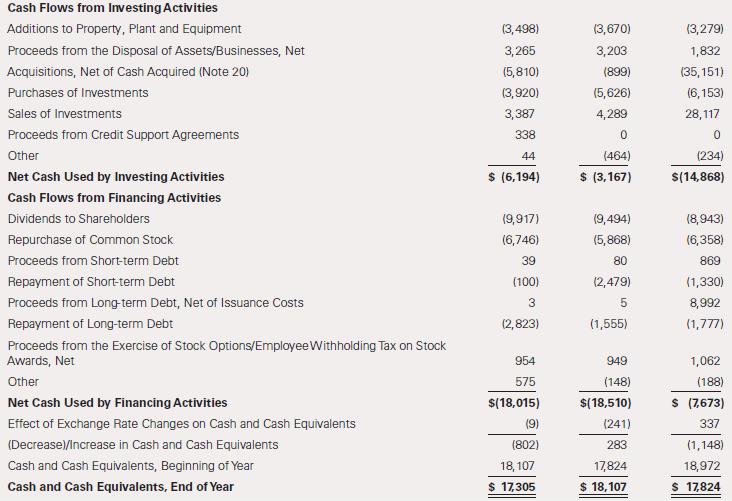

You are interested in analyzing Johnson & Johnson’s operating cash flows. Use Johnson & Johnson’s statement of cash flows in Exhibit 22.10 and the additional information to address the questions that follow:

Additional Information

a. What is Johnson & Johnson’s net cash flow from operations each year? What were the change and percentage of change in Johnson & Johnson’s net cash flow from operations each year? Compare the changes in net cash flow from operations to the changes in net income.

b. What are the major adjustments for noncash expenses and losses? What are the major adjustments for noncash revenues and gains?

c. Compute the following cash coverage ratios for each year and comment on them:

• Short-term debt coverage

• Debt coverage

• Dividend coverage

• Sales coverage

• OCF to income ratio

d. Compute Johnson & Johnson’s free cash flows for each year and comment on them. Compare Johnson & Johnson’s free cash flows to its operating cash flows for each year.

Sales Short-term debt Long-term debt 2019 2018 $51,750 $53,647 $16,195 $8,831 $35,955 $32,909 2017 $52,546 $ 9,953 $33,538

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

The question appears to be asking for a detailed analysis of Pfizers financial statements specifically cash flows and a comparison with Johnson Johnson The data provided includes various financial met... View full answer

Get step-by-step solutions from verified subject matter experts