Your examination of the records of Wilson Ltd, which was established on 1 March 2015, reveals that

Question:

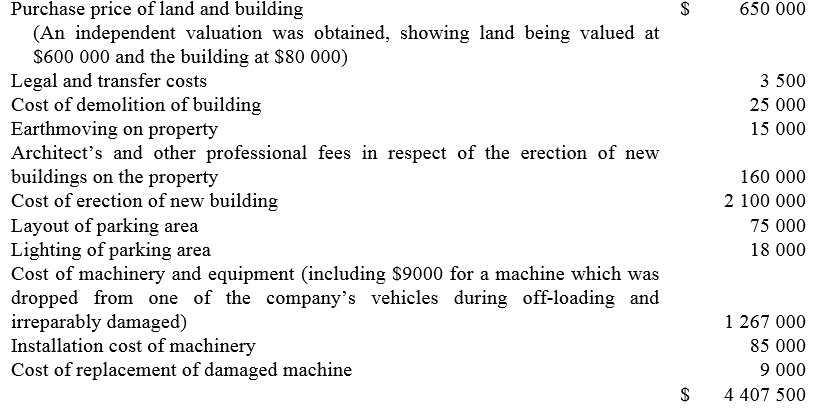

Your examination of the records of Wilson Ltd, which was established on 1 March 2015, reveals that the accountant debited the Land, Buildings and Equipment account with the following items (ignore GST):

Examination of the wage records shows that the salary of the manager, $4000 per month, was debited to the Salaries Expense account. From 1 March to 31 August 2015, he supervised the erection of the factory buildings, and from 1 September to 31 October 2015 he supervised the installation of the machinery.

The accountant credited sundry income with $8400, being $7000 received for scrap building material from the demolished building and $1400 for the damaged machine.

Required

A. Show journal entries to transfer the amounts to three different accounts, i.e. Land account, Buildings account and Machinery account.

B. Assuming that the enterprise started operations on 1 November 2015 and that its financial year ends on 31 March, journalise the following depreciation entries using the straight-line method:

1. buildings: useful life 40 years, $20 000 residual value

2. machinery: useful life 12 years and residual value amounting to 10% of cost.

Step by Step Answer:

Accounting

ISBN: 978-1118608227

9th edition

Authors: Lew Edwards, John Medlin, Keryn Chalmers, Andreas Hellmann, Claire Beattie, Jodie Maxfield, John Hoggett