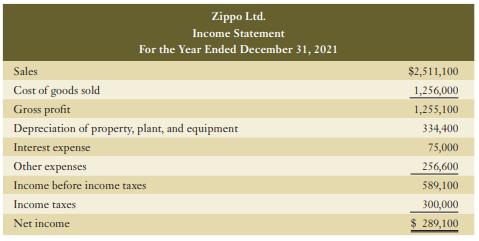

Zippos financial statements as at December 31, 2021, appear below: Additional information: Property, plant, and equipment

Question:

Zippo’s financial statements as at December 31, 2021, appear below:

Additional information:

■ Property, plant, and equipment costing $570,000 was sold for $422,000.

■ 100,000 ordinary shares were issued to acquire $450,000 of property, plant, and equipment.

■ $212,000 of deferred development costs were capitalized during the year.

■ The company nets many items to “Other Expenses,” for example, gains and losses on fixed asset sales and some amortization.

■ Bad debt expense for the year was $8,000.

■ The deferred product development expenditures were all paid in cash.

■ The decrease in the bonds payable account was due to the amortization of the premium.

■ Zippo has adopted a policy of classifying cash outflows from interest and dividends as financing activities.

Required:

a. Prepare a statement of cash flows for Zippo Ltd. for 2021 using the indirect method.

b. Identify what supplemental disclosure, if any, is required

c. Based on your analysis of Zippo’s cash flow activities during the year, do you think that you should consider investing in the company? Why or why not?

Step by Step Answer: