(Adjusting Entries and Financial Statements) Presented below are the trial balance and the other information related to...

Question:

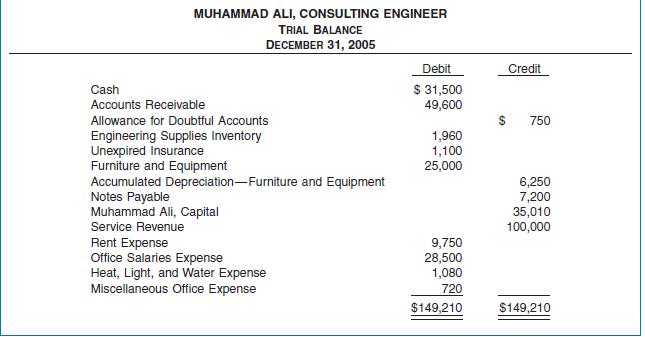

(Adjusting Entries and Financial Statements) Presented below are the trial balance and the other information related to Muhammad Ali, a consulting engineer.

1. Fees received in advance from clients $6,900.

2. Services performed for clients that were not recorded by December 31, $4,900.

3. Bad debt expense for the year is $1,430.

4. Insurance expired during the year $480.

5. Furniture and equipment is being depreciated at 12 1/2% per year.

6. Muhammad Ali gave the bank a 90-day, 10% note for $7,200 on December 1, 2005.

7. Rent of the building is $750 per month. The rent for 2005 has been paid, as has that for January 2006.

8. Office salaries earned but unpaid December 31, 2005, $2,510.

Instructions

(a) From the trial balance and other information given, prepare annual adjusting entries as of December 31, 2005.

(b) Prepare an income statement for 2005, a balance sheet, and a statement of owner’s equity. Muhammad Ali withdrew $17,000 cash for personal use during the year.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield