Bankruptcy Prediction The Z-score bankruptcy prediction model uses balance sheet and income information to arrive at a

Question:

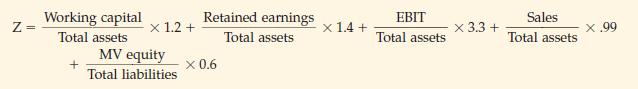

Bankruptcy Prediction The Z-score bankruptcy prediction model uses balance sheet and income information to arrive at a Z-Score, which can be used to predict financial distress:

EBIT is earnings before interest and taxes. MV Equity is the market value of common equity, which can be determined by multiplying stock price by shares outstanding.

Following extensive testing, it has been shown that companies with Z-scores above 3.0 are unlikely to fail; those with Z-scores below 1.81 are very likely to fail. While the original model was developed for publicly held manufacturing companies, the model has been modified to apply to companies in various industries, emerging companies, and companies not traded in public markets.

Instructions

(a) Use information in the financial statements of a company like PepsiCo or Coca-Cola to compute the Z-score for the past 2 years.

(b) Interpret your result. Where does the company fall in the financial distress range?

(c) The Z-score uses EBIT as one of its elements. Why do you think this income measure is used?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield