Being fairly new to the accounting team, you are eager to make a good impression in your

Question:

Being fairly new to the accounting team, you are eager to make a good impression in your meeting with the CFO. The meeting concerns the way you have proposed accounting for an upcoming issue of convertible bonds. Your proposal involves allocating the proceeds from the convertible bonds into two components and recording the fair value of the debt as a liability and the conversion option in an equity account. Upon seeing your proposal as part

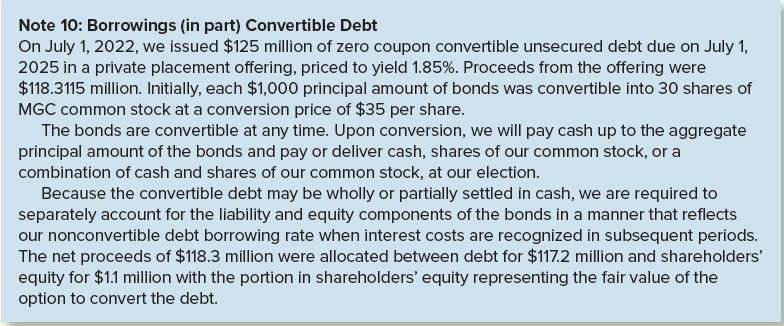

of an intra-team memo, your CFO sent you a personal reply asking for further explanation of your thinking, saying in part, “I thought that type of separation was practiced only under International Financial Reporting Standards. Under U.S. GAAP, don’t we simply record the proceeds entirely as debt?” To help bolster your explanation, you decide to provide an example of another company’s description of how it accounted for a similar debt issue, demonstrating how that company would record the related transactions, and to cite the relevant authoritative literature on accounting for convertible debt under certain circumstances using the FASB’s Codification Research System. Toward this end, you discover in the 2022 annual report of Mills General Corporation (MGC) the following disclosure note:

Required:

1. Prepare the journal entry that was recorded when the bonds were issued on July 1, 2023.

2. What amount of interest expense, if any, did MGC record the fiscal year ended June 30, 2024?

3. Normally under U.S. GAAP, we record the entire issue price of convertible debt as a liability. However, MGC’s note states that “Because the convertible debt may be wholly or partially settled in cash, we are required to separately account for the liability and equity components of the notes.” Obtain the relevant

authoritative literature on classification of debt expected to be financed using the FASB’s Codification Research System. You might gain access from the FASB website (www.fasb.org), from your school library, or some other source. Determine the criteria for reporting debt potentially convertible into cash. What is

the specific nine-digit Codification citation (XXX-XX-XX-XX) that MGC would rely on in applying that accounting treatment?

Step by Step Answer: