Cansela Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory

Question:

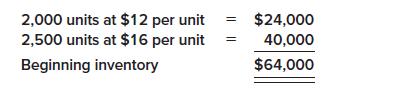

Cansela Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. The company began 2024 with inventory of 4,500 units of its only product. The beginning inventory balance of $64,000 consisted of the following layers:

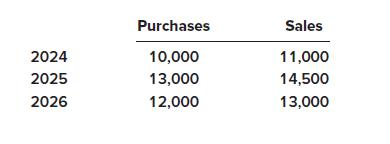

During the three years 2024–2026, the cost of inventory remained constant at $18 per unit. Unit purchases and sales during these years were as follows:

Required:

1. Calculate cost of goods sold for 2024, 2025, and 2026.

2. Disregarding income tax, determine the LIFO liquidation profit or loss, if any, for each of the three years.

3. Prepare the company’s LIFO liquidation disclosure note that would be included in the 2026 financial statements to report the effects of any liquidation on cost of goods sold and net income. Assume any liquidation effects are material and that Cansela’s effective income tax rate is 25%. Cansela’s 2026 financial statements include income statements for two prior years for comparative purposes.

Step by Step Answer: