Chance Enterprises leased equipment from Third Bank Leasing on January 1, 2024. Chance elected the short-term lease

Question:

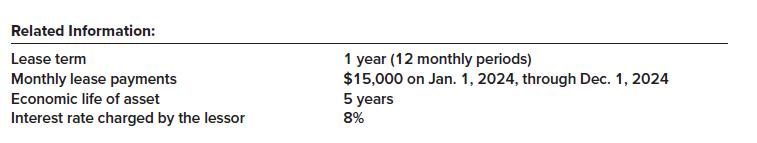

Chance Enterprises leased equipment from Third Bank Leasing on January 1, 2024. Chance elected the short-term lease option.

Required:

Prepare appropriate entries for Chance from the beginning of the lease through April 1, 2024.

Transcribed Image Text:

Related Information: Lease term Monthly lease payments Economic life of asset Interest rate charged by the lessor 1 year (12 monthly periods) $15,000 on Jan. 1, 2024, through Dec. 1, 2024 5 years 8%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

A lease that has a maximum possible lease term including opti...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Chance Enterprises leased equipment from Third Bank Leasing on January 1, 2018. Chance purchased the equipment at a cost of $1,000,000. Chance elected the short-term lease option. Appropriate...

-

Rand Medical manufactures lithotripters. Lithotripsy uses shock waves instead of surgery to eliminate kidney stones, Physicians Leasing purchased a lithotripter from Rand for $2,150,000 and leased it...

-

Manufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2013. Edison purchased the equipment from International Machines at a cost of $250,177. Both the lessee...

-

A car manufacturer designs a fuel-efficient car for 1993. The company argues that the car can attain an average of 45 miles per gallon. The miles per gallon of the car follows a normal distribution...

-

What is the difference between classical and operant conditioning?

-

Overloon BV is a repair-service company specialising in the rapid repair of photocopying machines. Each of its 10 clients pays a fixed monthly service fee (based on the type of photocopying machines...

-

Use a worksheet for employers pension plan entries.

-

Mills and Vines just received a bid from a supplier for 6,000 motors per year used in the manufacture of electric lawn mowers. The supplier offered to sell the motors for $88 each. Mills and Viness...

-

Nem PO Bono Dany symptom Question 47 5 pts Given the following contract terms, provide the cumulative net balance in period 6: Materials Suppliers: Paid within 30 days (Current) Subcontractors:...

-

Assume the shortest path in a graph from node A to node H is A B H. Also assume that the shortest path from node H to node N is H G N. What is the shortest path from node A to node N?

-

Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2024, Rhone-Metro leased equipment to Western Soya Co. for a four-year period ending December 31, 2028, at which...

-

Lahiri Leasing purchased a single-engine plane for $400,000 and leased it to Red Baron Flying Club for its fair value of $645,526 on January 1, 2024. Terms of the lease agreement and related facts...

-

Which of the following results in a recognized gain or loss? a. Kay sells her vacation cabin (adjusted basis of $100,000) for $150,000. b. Adam sells his personal residence (adjusted basis of...

-

Turn this information into an excel sheets with the excel formulas being shown P10.1 (LO 1) (Depreciation for Partial Period-SL, SYD, and DDB) Alladin Company purchased Machine #201 on May 1, 2025....

-

You are the Financial Analyst at Wellington Laboratories Ltd., a New Orleans, USA based bulk drugs manufacturer, which is evaluating the following project for manufacturing a new compound. Year Cash...

-

A variable mesh screen produces a linear and axisymmetric velocity profile as indicated below in the air flow through a 2-ft diameter circular cross section duct. The static pressures upstream and...

-

A vertical round steel rod 2 m long is securely held at its upper end. A weight can slide freely on the rod and its fall is arrested by a stop provided at the lower end of the rod. When the weight...

-

8) Determine the magnitudes of the forces F and P so that the single equivalent couple (i.e. the resultant of the three couples) acting on the triangular block is zero. Z -F F 3 m 10 N, 30 6 m 10 N 3...

-

Use a convergence test of your choice to determine whether the following series converge or diverge. 1 Ek sin k k=1

-

Match the following. Answers may be used more than once: Measurement Method A. Amortized cost B. Equity method C. Acquisition method and consolidation D. Fair value method Reporting Method 1. Less...

-

Alamar Petroleum Company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by Alamar. The company also pays 80%...

-

Alamar Petroleum Company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by Alamar. The company also pays 80%...

-

Alamar Petroleum Company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by Alamar. The company also pays 80%...

-

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five - year period. His annual pay raises are determined by his division s...

-

Consider a 5 year debt with a 15% coupon rate paid semi-annually, redeemable at Php1,000 par. The bond is selling at 90%. The flotation cost is Php50 per bind. The firm's tax bracket is 30%.

-

A project will generate annual cash flows of $237,600 for each of the next three years, and a cash flow of $274,800 during the fourth year. The initial cost of the project is $749,600. What is the...

Study smarter with the SolutionInn App