Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $2,000,000. This

Question:

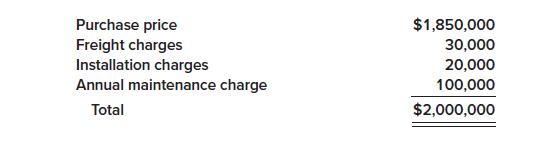

Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $2,000,000. This cost figure included the following expenditures:

The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The double-declining-balance method was used to determine depreciation expense for 2022 and 2023. In 2024, after the 2023 financial statements were issued, the company decided to switch to the straight-line depreciation method for this equipment. At that time, the company’s controller discovered that the original cost of the equipment incorrectly included one year of annual maintenance charges for the equipment.

Required:

1. Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2024.

2. Ignoring income taxes, prepare any 2024 journal entry(s) related to the change in depreciation methods.

Purchase price Freight charges Installation charges Annual maintenance charge Total $1,850,000 30,000 20,000 100,000 $2,000,000

Step by Step Answer:

Requirement 1 Requirement 2 This is a change in accounting principle accounted for as a change in estimate No entry is needed to record the change 202...View the full answer

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

The Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $2,000,000. This cost included the following expenditures: The company estimated an eight-year...

-

The Collins Corporation purchased office equipment at the beginning of 2016 and capitalized a cost of $2,000,000. This cost included the following expenditures: Purchase...

-

Collins Corporation purchased office equipment at the beginning of 2016 and capitalized a cost of $2,000,000. This cost figure included the following expenditures: Purchase...

-

Describe some practical examples of the single-resource sequencing problem.

-

Using the data in the worksheet Consumer Transportation Survey, develop 95% and 99% prediction intervals for the following: a. The hours per week that an individual will spend in his or her vehicle...

-

What is a double-entry accounting system?

-

E 7-4 Subsidiary purchases parent bonds On January 1, 2014, Petr SA purchased half of Lenka SAs outstanding 10 percent bond for $550,000 cash. Petr SA was the 80 percent-owned subsidiary of Lenka SA...

-

1. Consider a market with two firms managed by Harry and Vera. Under a cartel (both firms pick the high price), each firm earns a profit of $80. Under a duopoly (both firms pick the low price), each...

-

An investment in equity securities in which the investor owns 50% or more of the investees voting stock is classified as A. Controlling interest equity investments B. Trading equity investments C. No...

-

in February 2009, bushfires raced across the Australian state of Victoria. this terrible tragedy resulted in the loss of over 300 lives, Australias highest ever loss of life from a bushfire. In...

-

Described below are three independent and unrelated situations involving accounting changes. Each change occurs during 2024 before any adjusting entries or closing entries are prepared. a. On...

-

Dower Corporation prepares its financial statements according to IFRS. On March 31, 2024, the company purchased equipment for $240,000. The equipment is expected to have a six-year useful life with...

-

What is PPP and how does it help us to make valid international comparisons of GDP?

-

As part of the study on ongoing fright symptoms due to exposure to horror movies at a young age, the following table was presented to describe the lasting impact these movies have had during bedtime...

-

Exercise 1.10: State space realization Define a state vector and realize the following models as state space models by hand. One should do a few by hand to understand what the Octave or MATLAB calls...

-

Solve: (5)*+1 = 25x

-

The ball bearing made of steel is to be heat treated. It is heated to a temperature of 620C and then quenched in water that is at a temperature of 50C. The ball bearing has a diameter of 5 cm and the...

-

1. Using the net present value? method, calculate the comparative cost of each of the three payment plans being considered by New Med 2. Which payment plan should New Med choose? Explain. 3. Discuss...

-

Make sure, if possible, there is one foreign student in each small group. The group needs to discuss, and then report back to class on, the nature of business and entrepreneurship in the foreign...

-

a. Determine the domain and range of the following functions.b. Graph each function using a graphing utility. Be sure to experiment with the window and orientation to give the best perspective of the...

-

The following questions are adapted from a variety of sources including questions developed by the AICPA Board of Examiners and those used in the Kaplan CPA Review Course to study the income...

-

For the year ending December 31, 2013, Micron Corporation had income from continuing operations before taxes of $1,200,000 before considering the following transactions and events. All of the items...

-

The preliminary 2013 income statement of Alexian Systems, Inc., is presented below: ALEXIAN SYSTEMS, INC. Income Statement For the Year Ended December 31, 2013 ($ in millions, except earnings per...

-

The rate of return on Cherry Jalopies, Inc., stock over the last five years was 14 percent, 11 percent, 4 percent, 3 percent, and 7 percent. What is the geometric return for Cherry Jalopies, Inc.?

-

U.S. GAAP specifies all of the following characteristics of variable interest entities except: A. Equity holders hold less than 5% of the entitys voting stock. B. Equity holders do not have voting...

-

Rank the following three stocks by their risk-return relationship, best to worst. Night Ryder has an average return of 10 percent and standard deviation of 27 percent. The average return and standard...

Study smarter with the SolutionInn App