Duke Companys records show the following account balances at December 31, 2024: Income tax expense has not

Question:

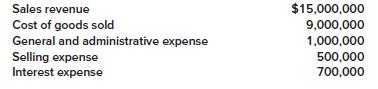

Duke Company’s records show the following account balances at December 31, 2024:

Income tax expense has not yet been determined. The following events also occurred during 2024. All transactions are material in amount.

1. $300,000 in restructuring costs were incurred in connection with plant closings.

2. Inventory costing $400,000 was written off as obsolete. Material losses of this type are considered to be unusual.

3. It was discovered that depreciation expense for 2023 was understated by $50,000 due to a mathematical error. The amount is considered material.

4. The company experienced a negative foreign currency translation adjustment of $200,000 and had an unrealized gain on debt securities of $180,000.

Required:

Prepare a single, continuous multiple-step statement of comprehensive income for 2024. The company’s effective tax rate on all items affecting comprehensive income is 25%. Each component of other comprehensive income should be displayed net of tax. Ignore EPS disclosures. Use a multiple-step format similar to the one in the Concept Review Exercise at the end of Part A of this chapter (excluding discontinued operations shown there).

Step by Step Answer: