For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired

Question:

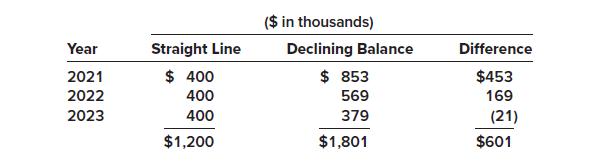

For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2021 for $2,560,000. Its useful life was estimated to be six years, with a $160,000 residual value. At the beginning of 2024, Clinton decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows:

Required:

1. Briefly describe the way Clinton should report this accounting change in the 2022–2024 comparative financial statements.

2. Prepare any 2024 journal entry related to the change.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: