For the year ended December 31, 2024, Fidelity Engineering reported pretax accounting income of $978,000. Selected information

Question:

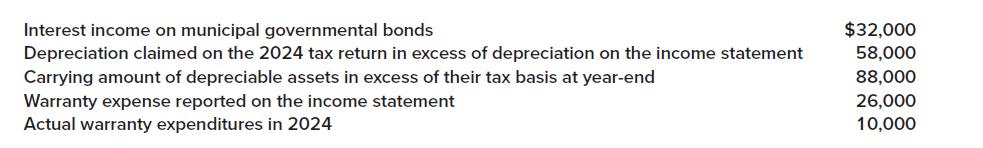

For the year ended December 31, 2024, Fidelity Engineering reported pretax accounting income of $978,000. Selected information for 2024 from Fidelity’s records follows:

Fidelity’s income tax rate is 25%. At January 1, 2024, Fidelity’s records indicated balances of zero and $7,500 in its deferred tax asset and deferred tax liability accounts, respectively.

Required:

1. Determine the amounts necessary to record income taxes for 2024, and prepare the appropriate journal entry.

2. What is Fidelity’s 2024 net income?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: