(Identification of Income Statement Deficiencies) John Amos Corporation was incorporated and began business on January 1, 2004....

Question:

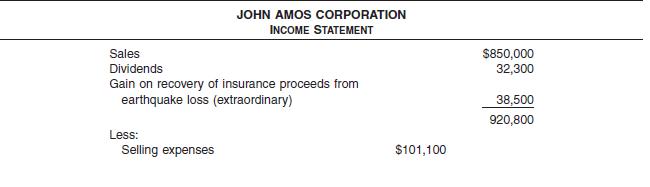

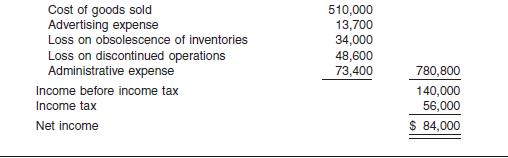

(Identification of Income Statement Deficiencies) John Amos Corporation was incorporated and began business on January 1, 2004. It has been successful and now requires a bank loan for additional working capital to finance expansion. The bank has requested an audited income statement for the year 2004. The accountant for John Amos Corporation provides you with the following income statement which John Amos plans to submit to the bank.

Instructions Indicate the deficiencies in the income statement presented above. Assume that the corporation desires a single-step income statement.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: