Kevin Brantly is a new hire in the controllers office of Fleming Home Products. Two events occurred

Question:

Kevin Brantly is a new hire in the controller’s office of Fleming Home Products. Two events occurred in late 2024 that the company had not previously encountered. The events appear to affect two of the company’s liabilities, but there is some disagreement concerning whether they also affect financial statements of prior years. Each change occurred during 2024 before any adjusting entries or closing entries were prepared. The tax rate for Fleming is 40% in all years.

• Fleming Home Products introduced a new line of commercial awnings in 2023 that carries a one-year warranty against manufacturer’s defects. Based on industry experience, warranty costs were expected to approximate 3% of sales. Sales of the awnings in 2023 were $3,500,000. Accordingly, warranty expense and a warranty liability of $105,000 were recorded in 2023. In late 2024, the company’s claims experience was evaluated, and it was determined that claims were far fewer than expected—2% of sales rather than 3%. Sales of the awnings in 2024 were $4,000,000 and warranty expenditures in 2024 totaled $91,000.

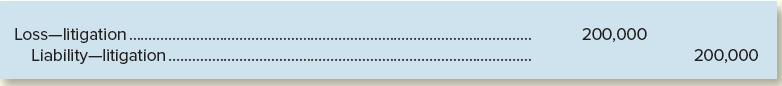

• In November 2022, the State of Minnesota filed suit against the company, seeking penalties for violations of clean air laws. When the financial statements were issued in 2023, Fleming had not reached a settlement with state authorities, but legal counsel advised Fleming that it was probable the company would have to pay $200,000 in penalties. Accordingly, the following entry was recorded:

Late in 2024, a settlement was reached with state authorities to pay a total of $350,000 in penalties.

Required:

Kevin’s supervisor, perhaps unsure of the answer, perhaps wanting to test Kevin’s knowledge, e-mails the message, “Kevin, send me a memo on how we should handle our awning warranty and that clean air suit.” Wanting to be accurate, Kevin consults his reference materials. What will he find? Prepare the memo requested.

Step by Step Answer: