Kyowa Hakko Kogyo Co., Ltd., is an R&Dbased company with special strengths in biotechnology. The company is

Question:

Kyowa Hakko Kogyo Co., Ltd., is an R&D–based company with special strengths in biotechnology. The company is dedicated to the creation of new value in the life sciences, especially in its two core business segments of pharmaceuticals and biochemicals, and strives to contribute to the health and well-being of people around the world. The company provided the following disclosures related to its retirement benefits in its 2005 annual report.

Kyowa Hakko Kogyo Co., Ltd.

Note 1. Basis of Presenting Consolidated Financial Statements (partial)

Kyowa Hakko Kogyo Co., Ltd. (the “Company”) maintains its accounts and records in accordance with the provisions set forth in the Japanese Commercial Code and the Securities and Exchange Law and in conformity with generally accepted accounting principles and practices prevailing in Japan. . . . The Company’s fiscal year is from April 1 to March 31. Therefore, “fiscal 2005” begins on April 1, 2004 and ends on March 31, 2005.

Reserve for Retirement Benefits to Employees A reserve for retirement benefits to employees is provided at an amount equal to the present value of the projected benefit obligation less fair value of the plan assets at the year-end. Unrecognized prior service costs are amortized on a straight-line basis over five years from the year they occur. Unrecognized actuarial differences are amortized on a straight-line basis over ten years from the year after they occur.

Note 8. Reserve for Retirement Benefits to Employees The Company and its domestic consolidated subsidiaries operate various defined benefit plans, including a corporate pension plan (the so-called cash-balanced plan), a group contributory plan, a tax-qualified pension plan and a severance payment plan.

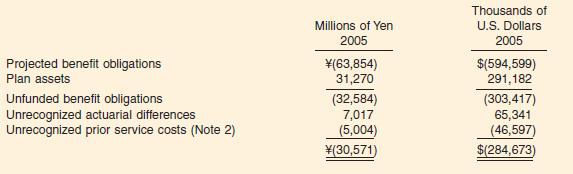

(a) The reserve for retirement benefits as of March 31, 2005, is analyzed as follows.

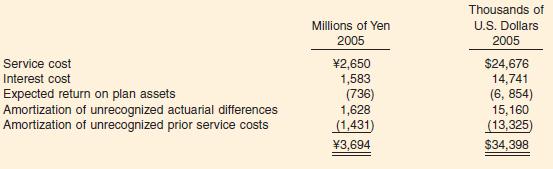

(b) The net periodic pension expense related to the retirement benefits for fiscal 2005 is as follows

(c) Assumptions used in calculation of the above information are as follows.

Instructions Use the information on Kyowa to respond to the following requirements.

(a) What are the key differences in accounting for pensions under U.S. and Japanese standards?

(b) Briefly explain how differences in U.S. and Japanese standards for pensions would affect the amounts reported in the financial statements.

(c) In light of the differences identified above, would Kyowa’s income and equity be higher or lower under U.S. GAAP compared to Japanese standards? Explain.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield