Nike, Inc., is a leading manufacturer of sports apparel, shoes, and equipment. The companys 2020 financial statements

Question:

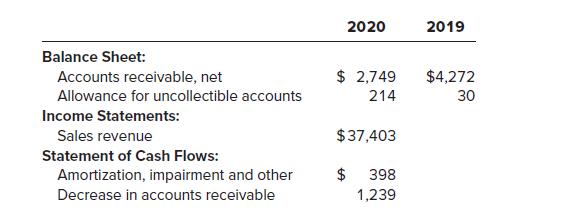

Nike, Inc., is a leading manufacturer of sports apparel, shoes, and equipment. The company’s 2020 financial statements contain the following information ($ in millions):

Assume that all sales are made on a credit basis.

Required:

1. What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019?

2. Assume that bad debt expense is included in “amortization, impairment and other,” such that the 2020 decrease in accounts receivable of $1,239 reflects only the difference between sales and collections. Prepare a T account that depicts how sales (S), collections (C), bad debt expense (E), and writeoffs of bad debts (W) affect the balance of net accounts receivable with a debit, a credit or not at all, and estimate Nike’s 2020 bad debt expense.

3. Prepare a T account that depicts how bad debt expense (E) and writeoffs of bad debts (W) affect the balance of the allowance for uncollectible accounts with a debit, credit or not at all, and estimate the amount of bad debts written off by Nike during 2020.

4. Analyze changes in the gross accounts receivable account to calculate the amount of cash received from customers during 2020.

5. Analyze changes in net accounts receivable to calculate the amount of cash received from customers during 2020.

Step by Step Answer: