Pandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2024, year-end

Question:

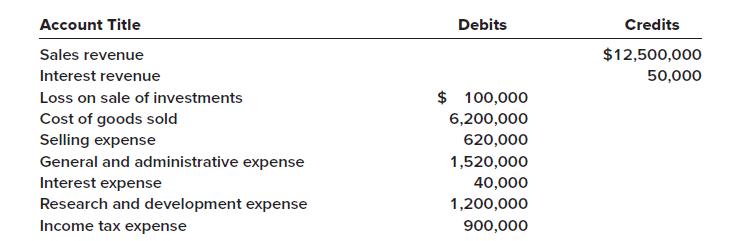

Pandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2024, year-end trial balance contained the following income statement items:

Required:

Calculate the company’s operating income for the year.

Transcribed Image Text:

Account Title Sales revenue Interest revenue Loss on sale of investments Cost of goods sold Selling expense General and administrative expense Interest expense Research and development expense Income tax expense Debits $ 100,000 6,200,000 620,000 1,520,000 40,000 1,200,000 900,000 Credits $12,500,000 50,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 42% (7 reviews)

Operating revenues Sales revenue Total operating revenues ...View the full answer

Answered By

Anoop V

I have five years of experience in teaching and I have National Eligibility in teaching (UGC-NET) .

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Hawthorn Corporations adjusted trial balance contained the following accounts at December 31, 2020: Retained Earnings $120,000, Common Stock $750,000, Bonds Payable $100,000, Paid-in Capital in...

-

Thomas Corporations adjusted trial balance contained the following liability accounts at December 31, 2020: Bonds Payable (due in 3 years) $100,000, Accounts Payable $72,000, Notes Payable (due in 90...

-

Patrick Corporations adjusted trial balance contained the following asset accounts at December 31, 2020: Prepaid Rent $12,000, Goodwill $50,000, Franchise Fees Receivable $2,000, Franchises $47,000,...

-

Here are the comparative income statements of Eudaley Corporation. Instructions (a) Prepare a horizontal analysis of the income statement data for Eudaley Corporation, using 2013 as a base. (Show the...

-

Which assumption about consumer preferences does each of the following individuals violate? a. Randy likes basketball more than football; football more than baseball; and baseball more than...

-

Jefferson Company acquired equipment on January 2, Year 1, at a cost of $10 million. The equipment has a five-year life, no residual value, and is depreciated on a straight-line basis. On January 2,...

-

Identify the differences between pensions and postretirement healthcare benefits.

-

The following selected circumstances relate to pending lawsuits for Erismus, Inc. Erismuss fiscal year ends on December 31. Financial statements are published in March 2012. Erismus prepares its...

-

Financial information for Nealon Inc is presented below December 31, 2020 December 31, 2019 Current assets $139,968 $108.000 Plant assets inet) 446,918 361.000 Current liabilities 93.024 76,000...

-

Chilwell Ltd prepares financial statements to 31 October each year. The company's trial balance at 31 October 2017 is as follows: The following information is also available: 1. Land is...

-

The following is a partial trial balance for the Green Star Corporation as of December 31, 2024: Required: 1. Prepare a single-step income statement by inserting the amounts above into the...

-

The current asset section of the Excalibur Tire Companys balance sheet consists of cash, marketable securities, accounts receivable, and inventory. The balance sheet revealed the following: Required:...

-

Use data from a study done at a college fitness center in which muscle mass of participants was measured before and after a 6-week program working with resistance bands to estimate the mean increase...

-

Analysis of the Volkswagen Scandal Possible Solutions for Recovery The Volkswagen scandal is a notorious example of how corporations can shape the ethical and political issues of the environment. The...

-

Shelby isn't sure if her forklift can safely handle the pallet she is being asked to move. What can she check to be sure

-

If schedule acceleration increases costs, how could schedule elongation reduce costs? If schedule acceleration increases costs, how could schedule elongation reduce costs? For the same total...

-

Laser Care Hospital is looking to raise tax-exempt municipal funds in the bond market. As an issuer of the bond, which of the following is not a part of the bond process that Laser Care Hospital will...

-

Find the critical value t a/2 corresponding to a 95% confidence level. (13.046, 22.15) X= 17.598 Sx= 16.01712719 n=50

-

Victorias 2018 tax return was due on April 15, 2019, but she did not file it until June 12, 2019. Victoria did not file an extension. The tax due on the tax return when filed was $8,500. In 2018,...

-

With your classmates, form small teams of skunkworks. Your task is to identify an innovation that you think would benefit your school, college, or university, and to outline an action plan for...

-

Define intraperiod tax allocation. Why is the process necessary?

-

Define intraperiod tax allocation. Why is the process necessary?

-

Define intraperiod tax allocation. Why is the process necessary?

-

September 1 . Purchased a new truck for $ 8 3 , 0 0 0 , paying cash. September 4 . Sold the truck purchased January 9 , Year 2 , for $ 5 3 , 6 0 0 . ( Record depreciation to date for Year 3 for the...

-

Find the NPV for the following project if the firm's WACC is 8%. Make sure to include the negative in your answer if you calculate a negative. it DOES matter for NPV answers

-

What is the value of a 10-year, $1,000 par value bond with a 12% annual coupon if its required return is 11%?

Study smarter with the SolutionInn App