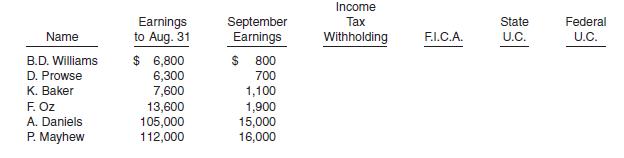

(Payroll Tax Entries) Below is a payroll sheet for Empire Import Company for the month of September...

Question:

(Payroll Tax Entries) Below is a payroll sheet for Empire Import Company for the month of September 2004. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% F.I.C.A. tax on employee and employer on a maximum of $84,900. In addition, 1.45% is charged both employer and employee for an employee’s wage in excess of $84,900 per employee.

Instructions

(a) Complete the payroll sheet and make the necessary entry to record the payment of the payroll.

(b) Make the entry to record the payroll tax expenses of Empire Import Company.

(c) Make the entry to record the payment of the payroll liabilities created. Assume that the company pays all payroll liabilities at the end of each month.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield