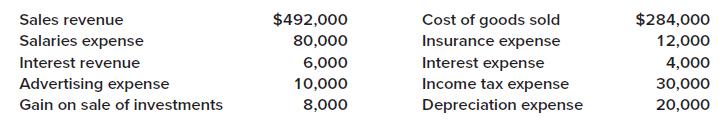

Presented below is income statement information of the Schefter Corporation for the year ended December 31, 2024.

Question:

Presented below is income statement information of the Schefter Corporation for the year ended December 31, 2024.

Required:

Prepare the necessary closing entries on December 31, 2024.

Transcribed Image Text:

Sales revenue Salaries expense Interest revenue Advertising expense Gain on sale of investments $492,000 80,000 6,000 10,000 8,000 Cost of goods sold Insurance expense Interest expense Income tax expense Depreciation expense $284,000 12,000 4,000 30,000 20,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

December 31 2024 Sales revenue Interest revenue Gain on sale of ...View the full answer

Answered By

Jacob Festus

I am a professional Statistician and Project Research writer. I am looking forward to getting mostly statistical work including data management that is analysis, data entry using all the statistical software’s such as R Gui, R Studio, SPSS, STATA, and excel. I also have excellent knowledge of research and essay writing. I have previously worked in other Freelancing sites such as Uvocorp, Essay shark, Bluecorp and finally, decided to join the solution inn team to continue with my explicit work of helping dear clients and students achieve their Academic dreams. I deliver, quality and exceptional projects on time and capable of working under high pressure.

4.90+

1263+ Reviews

2858+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Problem 5[4 points]: Assume a computer with a processor that has the following characteristics: CPI: 1 cycle Instruction miss rate: 1.5% Data miss rate: 4.0% Percentage of memory instructions: 30%...

-

Question 1 1. With the aid of a suitable supporting diagram, outline the purpose and key components of a Decision Support System (DSS). 2. With reference to the diagram you provided in your answer to...

-

The following cash data for the year ended December 31 were adapted from a recent annual report of Alphabet (GOOG), formerly known as Google. The cash balance as of January 1 was $18,347 (in...

-

The following recreation demand function is for a beach: x = 4 (p/500) + q. The visitation amount is represented by x (times), the travel cost is represented by p (yen), and the water quality is...

-

A study finds that during blizzards, online sales are highly associated with the number of snow plows on the road; the more plows, the more online purchases. The director of an association of online...

-

Discuss the social value of new-product development activities that seem to encourage people to discard products that are not all worn out. Is this an economic waste? How worn out is all worn out?...

-

1 5 Give some illustrations of your own about the way in which the history of a country has affected its culture, and how that in turn affects the management of organisations there.

-

On January 1, 2010, Cayce Corporation acquired 100 percent of Simbel Company for consideration paid of $126,000, which was equal to fair value. Cayce is a U.S.-based company headquartered in Buffalo,...

-

7 After a company reaches the breakeven point out of Select one: a. The contribution margin per unit is higher than the fixed costs per unit b. The contribution margin ratio is negative c. The total...

-

In a small group, identify a problem faced by a local business or charitable organization and propose a research project addressing that problem. Develop a research proposal that implements each step...

-

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2024, trial balances contained the following account information: The following...

-

Prepare the necessary adjusting entries on December 31, 2024, for the Microchip Company for each of the following situations. Assume that no financial statements were prepared during the year and no...

-

Go to the St. Louis Federal Reserve FRED database, and find data on net worth of households (TNWBSHNO) and the net percentage of domestic banks tightening standards for prime mortgage loans (DRTSPM)....

-

Financial Reporting Problem: Columbia Sportswear Company The financial statements for the Columbia Sportswear Company can be found in Appendix A at the end of this book. The following selected...

-

The retained earnings on a balance sheet are \(\$ 80,000\). Without seeing the rest of the balance sheet, can you conclude that stockholders should be able to receive a dividend in the amount of \(\$...

-

Determine the missing amount in each of the following cases: Assets Liabilities Stockholders' Equity $350,000 $155,000 ? $95,000 $225,000 ? ? $40,000 $ 59,000

-

Construct a 5-to-32-line decoder with four 3-to-8-line decoders with enable and one 2-to-4-line decoder. Use block diagrams similar to Fig. 2-3. Fig. 2-3 Ao A A 2 21 E 2 21 E 2x4 decoder 2x4 decoder...

-

After reconciling its bank account, Obian Company made the following adjusting entries: Required Identify the event depicted in each journal entry as asset source (AS), asset use (AU), asset exchange...

-

Following are the cash flows for three investments (originally presented in end-of-chapter problem 25) that actually occur at the beginning of each year rather than at the end of each year. a. Find...

-

The test statistic in the NeymanPearson Lemma and the likelihood ratio test statistic K are intimately related. Consider testing H 0 : = 0 versus H a : = a , and let * denote the test statistic...

-

Explain the role of the auditor in the financial reporting process.

-

Explain the role of the auditor in the financial reporting process.

-

List three key provisions of the Sarbanes-Oxley Act of 2002. Order your list from most important to least important in terms of the likely long-term impact on the accounting profession and financial...

-

question 6 Timely Inc. produces luxury bags. The budgeted sales and production for the next three months are as follows july. august september Sales, in units 1,115. 1229. 1302 Production. in units...

-

On May 12 Zimmer Corporation placed in service equipment (seven-year property) with a basis of $220,000. This was Zimmer's only asset acquired during the year. Calculate the maximum depreciation...

-

Power Manufacturing has equipment that it purchased 7 years ago for $2,550,000. The equipment was used for a project that was intended to last for 9 years and was being depreciated over the life of...

Study smarter with the SolutionInn App