Rice Corporation is negotiating a loan for expansion purposes and the bank requires financial statements. Before closing

Question:

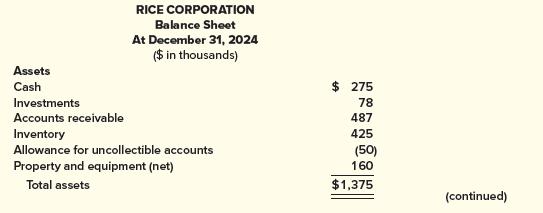

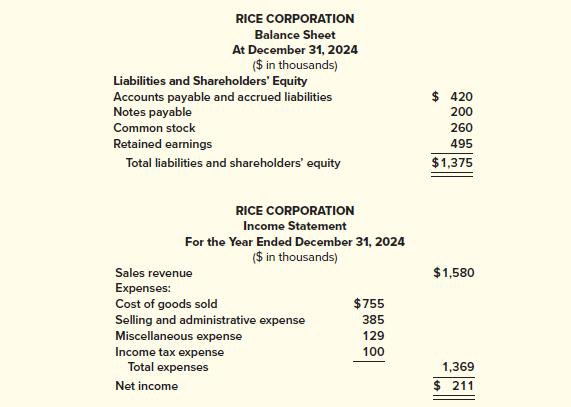

Rice Corporation is negotiating a loan for expansion purposes and the bank requires financial statements. Before closing the accounting records for the year ended December 31, 2024, Rice’s controller prepared the following financial statements:

Additional Information:

1. The company’s common stock is traded on an organized stock exchange.

2. The investment portfolio consists of short-term investments valued at $57,000. The remaining investments will not be sold until the year 2026.

3. Notes payable consist of two notes:

Note 1: $80,000 face value dated September 30, 2024. Principal and interest at 10% are due on September 30, 2025.

Note 2: $120,000 face value dated April 30, 2024. Principal is due in two equal installments of $60,000 plus interest on the unpaid balance. The two payments are scheduled for April 30, 2025, and April 30, 2026. Interest on both loans has been correctly accrued and is included in accrued liabilities on the balance sheet and selling and administrative expense in the income statement.

4. Included in miscellaneous expense is loss from discontinued operations of $90,000 (net of tax).

Required:

Identify the deficiencies in the presentation of the statements prepared by the company’s controller. Do not prepare corrected statements.

Step by Step Answer: