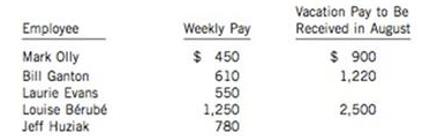

Sultanaly Limited, a private company following ASPE, pays its office employees each week. A partial list follows

Question:

Sultanaly Limited, a private company following ASPE, pays its office employees each week. A partial list follows of employees and their payroll data for August. Because August is the vacation period, vacation pay is also listed.

Assume that the income tax withheld is 10% of salaries and that union dues withheld are 1% of gross salary. Vacations are taken in the second and third weeks of August by Olly, Ganton, and Bérubé. The Employment Insurance rate is 1.88% for employees and 1.4 times that for employers. The CPP rate is 4.95% each for employee and employer.

Instructions

(a) Prepare the journal entries that are necessary for each of the four August payrolls. The entries for the payroll and for Sultanaly's payroll tax are made separately.

(b) Prepare the entry to record the monthly payment of accrued payroll liabilities.

(c) Prepare the entry to accrue the 4% vacation entitlement that was earned by employees in August. (No entitlement is earned on vacation pay.)

(d) When Sultanaly prepares its income statement, it groups salaries and wages expense with payroll tax expense and labels the amount "Salaries and related expenses." Therefore, the bank cannot figure out exactly how much is being paid to employees. Any outstanding vacation wages payable is grouped with other accruals of expenses and shown as accrued liabilities in the current liability section of Sultanaly's balance sheet. You are Sultanaly's banker. Do you feel that you require more detail concerning the combined expense on the income statement or combined accrued liabilities on the balance sheet?

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119048541

11th Canadian edition Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy