The following condensed information was reported by Peabody Toys, Inc., for 2024 and 2023: Required: 1. Determine

Question:

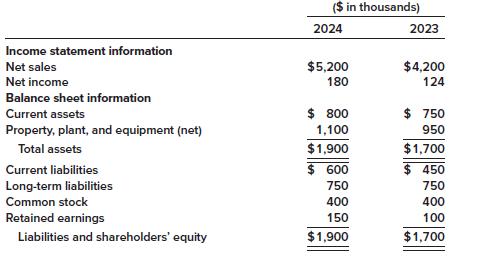

The following condensed information was reported by Peabody Toys, Inc., for 2024 and 2023:

Required:

1. Determine the following ratios for 2024:

a. Profit margin on sales

b. Return on assets

c. Return on equity

2. Determine the amount of dividends paid to shareholders during 2024.

Transcribed Image Text:

Income statement information Net sales Net income Balance sheet information Current assets Property, plant, and equipment (net) Total assets Current liabilities Long-term liabilities Common stock Retained earnings Liabilities and shareholders' equity ($ in thousands) 2024 $5,200 180 $ 800 1,100 $1,900 $ 600 750 400 150 $1,900 2023 $4,200 124 $ 750 950 $1,700 $ 450 750 400 100 $1,700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

Requirement 1 a Profit margin on sales b Return on asset...View the full answer

Answered By

Michael Owens

I am a competent Software Engineer with sufficient experience in web applications development using the following programming languages:-

HTML5, CSS3, PHP, JAVASCRIPT, TYPESCRIPT AND SQL.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following condensed information was reported by Peabody Toys, Inc., for 2011 and 2010: Required: 1. Determine the following ratios for 2011: a. Profit margin on sales b. Return on assets c....

-

The following condensed information is reported by Sporting Collectibles. Required: 1. Calculate the following profitability ratios for 2013: a. Gross profit ratio. b. Return on assets. c. Profit...

-

The ABC Corporation has a profit margin on sales below the industry average, yet its ROA is above the industry average. What does this imply about its asset turnover?

-

: Transcellular fluid is Specialized type of intercellular fluid O Found in confined space O includes fluid in synovial C 2+3 None of the following O

-

1. What adjustments were required at P&G as changes were made? 2. What sources of resistance to change do you suspect were encountered at P&G and how do you think they were overcome?

-

What is the difference between the distribution of income and the distribution of wealth? Describe the distribution of income and the distribution of wealth in the United States.

-

(g) Plot the shrunk means against the simple means. Again, identify any crossovers.

-

Christie Realty loaned money and received the following notes during 2012. Requirements For each note, compute interest using a 360-day year. Explanations are not required. 1. Determine the due date...

-

The standard cost of product 777 includes 2.7 units of direct materials at $5.50 per unit. During August, the company bought 29,200 units of materials at $5.55 and used those materials to produce...

-

As noted in Section 3.15, for single crystals of some substances, the physical properties are anisotropic; that is, they are dependent on crystallographic direction. One such property is the modulus...

-

The 2024 income statement of Anderson Medical Supply Company reported net sales of $8 million, cost of goods sold of $4.8 million, and net income of $800,000. The following table shows the companys...

-

Stone Company is facing several decisions regarding investing and financing activities. Address each decision independently. 1. On June 30, 2024, the Stone Company purchased equipment from Paper...

-

Describe each of the three parts of the SIY course. Which do you think would be the hardest to master? Why?

-

I need help with discussion posts that respond to 3 of these comments. 2 of them being the first on each picture. RUBRIC: articles to mention Coleman, R., & Banning, S. (2006). Network TV news'...

-

2. Best Use of Scarce Resource DigiCom Corporation produces three sizes of television sets: 12-inch screen, 26-inch screen, and 40-inch screen. Revenue and cost information per unit for each product...

-

Gunther invested $15,000 into a segregated fund with a 65% maturity guarantee 10 years ago. The fund is now maturing and has a current market value of $22,261. Gunther decides to withdraw his...

-

(a) Consider the following financial data (in millions of dollars) for Costello Laboratories over the period of 2014-2018: Year Sales Net income Total assets Common equity 2014 $3,800 $500 $3,900...

-

The Pizza Pie 'N Go sells about 2300 one-topping pizzas each month. The circle graph displays the most requested one-topping pizzas, by percentage, for one month. Most Popular One-Topping Pizzas...

-

Benito is age 29 and single. During all of 2018, he did not have qualifying health coverage nor was he eligible for an exemption. His household income was $47,650. What is the amount of shared...

-

For each of the following transactions, indicate whether it increases, decreases, or has no effect on the following financial ratios: current ratio, debt-to-equity ratio, profit margin ratio, and...

-

Presented below is the 2011 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare Tiger's statement of cash flows, using the indirect method to present...

-

Refer to the situation described in Exercise 4-22. Required: Prepare the cash flows from operating activities section of Tiger's 2011 statement of cash flows using the direct method. Assume that all...

-

The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. Obtain the relevant authoritative literature on...

-

Machinery is purchased on May 15, 2015 for $120,000 with a $10,000 salvage value and a five year life. The half year convention is followed. What method of depreciation will give the highest amount...

-

Flint Corporation was organized on January 1, 2020. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 514,000 shares of no-par common stock with a stated value of $2...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

Study smarter with the SolutionInn App