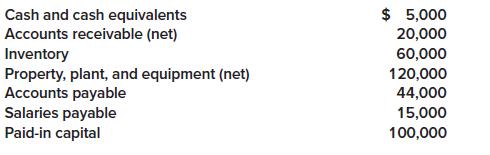

The following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation: The

Question:

The following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation:

The only asset not listed is short-term investments. The only liabilities not listed are $30,000 notes payable due in two years and related accrued interest payable of $1,000 due in four months. The current ratio at year-end is 1.5:1.

Required:

Determine the following at December 31, 2024:

1. Total current assets

2. Short-term investments

3. Retained earnings

Cash and cash equivalents Accounts receivable (net) Inventory Property, plant, and equipment (net) Accounts payable Salaries payable Paid-in capital $ 5,000 20,000 60,000 120,000 44,000 15,000 100,000

Step by Step Answer:

1 Total current assets Current liabilities 44000 15000 1000 interest payable 6...View the full answer

Related Video

The current ratio is a financial ratio that measures a company\'s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing a company\'s current assets by its current liabilities. The formula for calculating the current ratio is: Current Ratio = Current Assets / Current Liabilities Current assets are assets that can be converted to cash within one year, while current liabilities are debts that are due within one year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has enough current assets to cover its current liabilities. A current ratio of less than 1:1 may suggest that a company may have difficulty meeting its short-term obligations. It\'s important to note that the current ratio is just one of many financial ratios that can be used to assess a company\'s financial health. It should be used in conjunction with other financial ratios and qualitative factors to make informed decisions about investing or lending to a company.

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following selected information is available for two competitors, Nike, Inc. and Adidas AG: Instructions (a) Calculate the payout, dividend yield, and price-earnings ratios for each company. (b)...

-

The following comparative information is available for Prasad Company for 2012. Instructions(a) Determine net income under each approach. Assume a 30% tax rate.(b) Determine net cash provided by...

-

There are 38 numbers in the game of roulette. They are 00, 0, 1, 2, . . ., 36. Each number has an equal chance of being selected. In the game, the winning number is found by a spin of the wheel. Say...

-

A least squares regression line was calculated to relate the length (cm) of newborn boys to their weight in kg. The line is weight = -5.94 + 0.1875 length. Explain in words what this model means....

-

The following TI-84 Plus calculator display presents a 95% confidence interval for the difference between two proportions. a. Find the point estimate of pt p2. b. Fill in the blanks: We are 95%...

-

1 Identify the main characteristics of the respective cultures in your group.

-

Solve these various time value of money scenarios. 1. Suppose you invest a sum of $ 3,500 in an interest- bearing account at the rate of 10% per year. What will the investment be worth six years from...

-

The answers in the box appear to be incorrect Required information [The following information applies to the questions displayed below.) On January 1, Boston Company completed the following...

-

Suggest a design pattern that you encounter in a category of everyday things (e.g., consumer electronics, automobiles, appliances). Briefly describe the pattern.

-

A manufacturing company reports the following information. Required 1. Compute raw materials inventory turnover for the most recent two years. 2. Is the current year change in raw materials inventory...

-

Indicate whether each of the following assets and liabilities typically should be classified as current or long-term: (a) Accounts receivable within the next 60 days; (b) Prepaid rent for the next...

-

In what ways might telling them what youre going to say, saying it, and then telling them what youve just said have helped Clares audience?

-

The following information is available for two different types of businesses for the 2011 accounting period. Dixon Consulting is a service business that provides consulting services to small...

-

Marino Basket Company had a \(\$ 6,200\) beginning balance in its Merchandise Inventory account. The following information regarding Marino's purchases and sales of inventory during its 2011...

-

On March 6, 2011, Bob's Imports purchased merchandise from Watches Inc. with a list price of \(\$ 31,000\), terms \(2 / 10, n / 45\). On March 10, Bob's returned merchandise to Watches Inc. for...

-

The following events apply to Tops Gift Shop for 2012, its first year of operation: 1. Acquired \(\$ 45,000\) cash from the issue of common stock. 2. Issued common stock to Kayla Taylor, one of the...

-

Indicate whether each of the following costs is a product cost or a period (selling and administrative) cost. a. Transportation-in. b. Insurance on the office building. c. Office supplies. d. Costs...

-

Based upon your answers to Question 1, which asset appears riskiest based on standard deviation? Based on coefficient of variation? Asset Annual Returns A 5%, 10%, 15%, 4% B -6%, 20%, 2%, 5%, 10%...

-

Given that all the choices are true, which one concludes the paragraph with a precise and detailed description that relates to the main topic of the essay? A. NO CHANGE B. Decades, X-ray C. Decades...

-

What is the nuclear fuel of the nuclear industry?

-

An annual report of the Maytag Corporation contained the following excerpt: The Company announced the restructuring of its major appliance operations in an effort to strengthen its position in the...

-

Distinguish between the indirect and direct methods of reporting net cash flows provided by (used in) operating activities.

-

Duncan Inc. issued 500, $1,200, 8%, 25 year bonds on January 1, 2020, at 102. Interest is payable on January 1. Duncan uses straight-line amortization for bond discounts or premiums. INSTRUCTIONS:...

-

WISE-HOLLAND CORPORATION On June 15, 2013, Marianne Wise and Dory Holland came to your office for an initial meeting. The primary purpose of the meeting was to discuss Wise-Holland Corporation's tax...

-

Stock in ABC has a beta of 0.9. The market risk premium is 8%, and T-bills are currently yielding 5%. The company's most recent dividend is $1.60 per share, and dividends are expected to grow at a 6%...

Study smarter with the SolutionInn App