The following disclosure note appeared in the July 27, 2019, annual report of Cisco Systems, Inc. Note

Question:

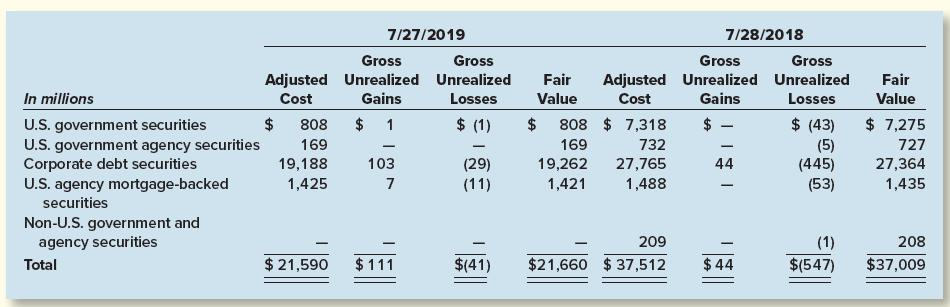

The following disclosure note appeared in the July 27, 2019, annual report of Cisco Systems, Inc. Note 9: Available-for-Sale Debt Investments and Equity Investments (in part) Available-for-sale investments as of July 27, 2019, and July 28, 2018, were as follows:

Note 9 also indicates that, during 2019, the net realized losses on sales of available-for-sale investments were $13 million. Cisco’s Note 16 (Comprehensive Income) indicates unrealized holding gains of $560 million during 2019, as well as reclassification of $13 for losses that had previously been included in AOCI and recorded in the fair value adjustment but which were now being included in net income after being realized upon sale.

Required:

1. Draw a T-account that shows the change between the July 28, 2018, and July 27, 2019, balances for the fair value adjustment associated with Cisco’s AFS investments for fiscal 2019. By how much did the fair value adjustment change during 2019?

2. Prepare a journal entry that records any unrealized holding gains and losses that occurred during 2019. Ignore income taxes.

3. Prepare a journal entry that records any reclassification adjustment for available-for-sale investments sold during 2019. Ignore income taxes.

4. Using your journal entries from requirements 2 and 3, adjust your T-account from requirement 1. Have you accounted for the entire change in the fair value adjustment that occurred during 2019? If not, speculate as to the cause of any difference.

Step by Step Answer: