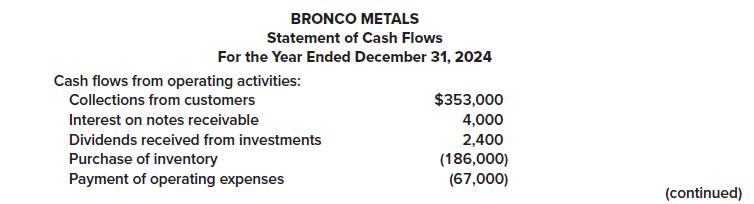

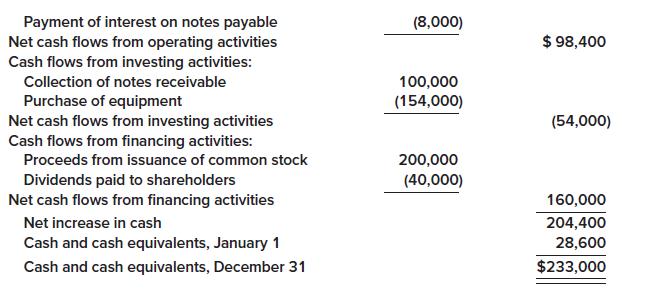

The statement of cash flows for the year ended December 31, 2024, for Bronco Metals is presented

Question:

The statement of cash flows for the year ended December 31, 2024, for Bronco Metals is presented below.

Required:

Prepare the statement of cash flows assuming that Bronco prepares its financial statements according to International Financial Reporting Standards. Where IFRS allows flexibility, use the classification used most often in IFRS financial statements.

Transcribed Image Text:

BRONCO METALS Statement of Cash Flows For the Year Ended December 31, 2024 $353,000 4,000 2,400 (186,000) (67,000) Cash flows from operating activities: Collections from customers Interest on notes receivable Dividends received from investments Purchase of inventory Payment of operating expenses (continued)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

Consistent with US GAAP international standards also require a statement of cash flows Consistent wi...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The statement of cash flows for the year ended December 31, 2013, for Bronco Metals is presented below. Required: Prepare the statement of cash flows assuming that Bronco prepares its financial...

-

The statement of cash flows for the year ended March 1.2008 (fiscal 2007), of Bed, Bath and Beyond. Inc. (BBB), a U.S. home products retailer, appears in Exhibit 1.12. BBB reports all amounts in...

-

8 for 0 < < 6 for 6

-

From the original setup in Problem 2, suppose that the quantity supplied of flat panel TV stands is represented by QS = 8P 20 Pi 200, where P is the price of the stand and Pi is the price of...

-

How effective is antitrust?

-

(Ratio Computations and Additional Analysis) Carl Sandburg Corporation was formed 5 years ago through a public subscription of common stock. Robert Frost, who owns 15% of the common stock, was one of...

-

Hammer Orthopedic Corporation periodically invests large sums in marketable equity securities. The investment policy is established by the investment committee of the board of directors and the...

-

SOLUTION REQUIRED ASAP. PLEASE HELP. (10) 1 800 3 4 6 Question - 3 The account balances of the Yamina & Company for the year ended December 31, 2021 is as under Sr. No Title of Accounts Amount Cash...

-

(b) Assume that Vietnam and Korea produce only two goods: noodles and wine. Further assume that each country is endowed with 300 labor hours which can be used to produce noodles and wine. The...

-

During 2024, Rogue Corporation reported net sales of $600,000. Inventory at both the beginning and end of the year totaled $75,000. The inventory turnover ratio for the year was 6.0. What amount of...

-

Presented below is the 2024 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare Tigers statement of cash flows, using the indirect method to present...

-

The amount a company expects to collect from customers appears on the a. balance sheet in the current assets section. b. balance sheet in the stockholders equity section. c. statement of cash flows....

-

Shire Company's predetermined overhead rate is based on direct labor cost. Management estimates the company will incur $649,000 of overhead costs and $590,000 of direct labor cost for the period....

-

You plan to live 25 years after you retire. You want to withdraw $100,000 each year for 25 years. Your first withdrawal will take place the day after you retire. What is the four annuity formulas...

-

Harwood Company's quality cost report is to be based on the following data: 2021 2022 Depreciation of test equipment $94,000 $95,000 Audits of the effectiveness of the quality system $54,000 $51,000...

-

Cash contribution of 4,000 to the Accounting Society (a charity) Purchase of art object at an Accounting Society Charitable event for $1,200 (FMV $800) Donation of 3-year-old clothing (basis 800; FMV...

-

The government is issuing $100 million in 10 year debt and receives the following bids. $25 million is reserved for non-competitive tenders. At what yield will the non-competitive tenders be issued...

-

Cameron is single and has taxable income of $93,341. Determine his tax liability using the Tax Tables and using the Tax Rate Schedule. Why is there a difference between the two amounts?

-

we have to compute the letter grades for a course. The data is a collection of student records stored in a file. Each record consists of a name(up to 20 characters), ID (8 characters), the scores of...

-

The statement of cash flows classifies all cash inflows and outflows into one of the three categories shown below and lettered from a through c. In addition, certain transactions that do not involve...

-

The following summary transactions occurred during 2011 for Bluebonnet Bakers: The balance of cash and cash equivalents at the beginning of 2011 was $17,000. Required: Prepare a statement of cash...

-

Refer to the situation described in Exercise 4-16. Required: How might your solution differ if Bluebonnet Bakers prepares the statement of cash flows according to International Financial Reporting...

-

XF Ltd. Is an expanding private company in the electric trade. Accounts preparing in January 2019 included the following information: Profit Statement for the year ended 31 st December 2018 Kshs.000...

-

Check On June 15, 2021, Sanderson Construction entered into a long-term construction contract to build a baseball stadium in Washington D.C., for $340 million. The expected completion date is April...

-

Q.1 Bassem Company purchased OMR420,000 in merchandise on account during the month of April, and merchandise costing OMR $350,000 was sold on account for OMR 425,000. Required: 1. Prepare journal...

Study smarter with the SolutionInn App