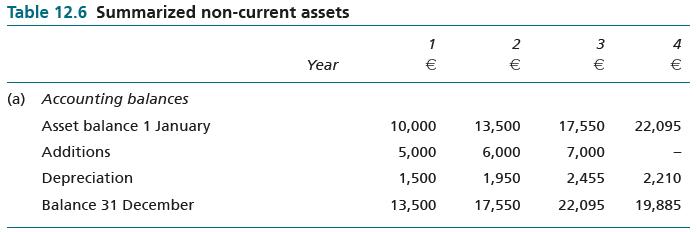

A company has a group of non-current assets that are summarized in its accounting records as shown

Question:

A company has a group of non-current assets that are summarized in its accounting records as shown in Table 12.6.

For tax purposes the asset balance brought forward on 1 January of year 1 is :7,000.

Tax depreciation is available at the rate of 20 per cent per annum on the reducing balance basis. The tax rate is 30 per cent in years 1 and 2 but falls to 20 per cent in years 3 and 4.

Prepare a tabular summary of the tax balances relating to this group of assets over the four years of the example, calculate deferred tax balances for each of the four years and show the effect of deferred tax on the income statement for years 2, 3 and 4.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An International Introduction

ISBN: 9781292102993

6th Edition

Authors: David Alexander, Christopher Nobe

Question Posted: