Home Inc. (a US company) has a wholly-owned subsidiary, S, which it acquired on 1 January X0.

Question:

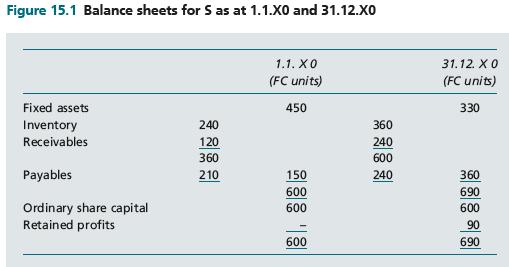

Home Inc. (a US company) has a wholly-owned subsidiary, S, which it acquired on 1 January X0. The balance sheets of S as at 1 January X0 and 31 December X0 are as set out in Figure 15.1 in foreign currency (FC) units:

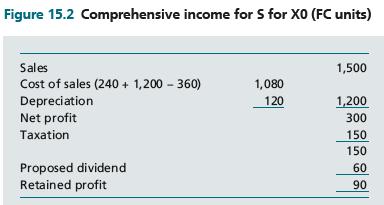

The comprehensive income for the year to 31 December X0 is as set out in Figure 15.2

Translate the financial statements of S using

(a) the closing rate method (i.e. assuming that the functional currency of the subsidiary is that of the FC) and then

(b) temporal method (i.e. assuming that the subsidiary’s functional currency is the same as the $), given the following:

On 1 January 20X0, $1 = FC3.0

On 30 June 20X0, $1 = FC2.5

On 31 December 20X0, $1 = FC2.0

Step by Step Answer:

Financial Accounting An International Introduction

ISBN: 9781292102993

6th Edition

Authors: David Alexander, Christopher Nobe