The president of Modular Office of Brazil (MOB), the wholly owned Brazilian subsidiary of U.S.- based Modular

Question:

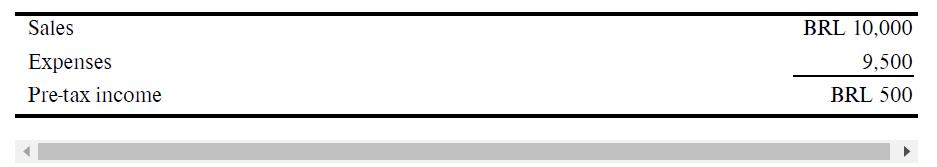

The president of Modular Office of Brazil (MOB), the wholly owned Brazilian subsidiary of U.S.- based Modular Office Corporation receives a compensation package that consists of a combination of salary and bonus. The annual bonus is calculated as a predetermined percentage of the pre-tax income earned by MOB. Brazil's national currency is the Brazilian real (BRL), which has been falling in value against the U.S. dollar. A condensed income statement for MOB for the most recent year is as follows (amounts in thousands of BRL):

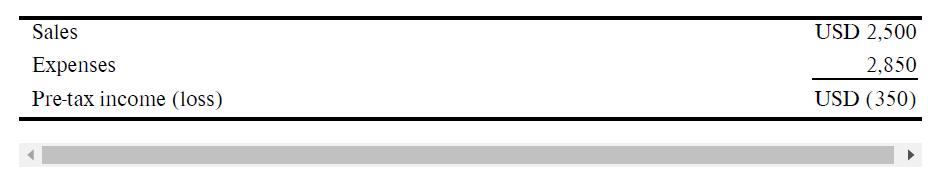

MOB's production is highly automated and depreciation on machinery is the company's major expense. After translating the BRL income statement into U.S. dollars (USD), the condensed income statement for MOB appears as follows (amounts in thousands of USD):

Required:

a. Speculate as to how MOB’s BRL pre-tax income became a USD pre-tax loss.

b. Discuss whether the president of MOB should be paid a bonus or not.

Step by Step Answer:

International Accounting

ISBN: 9781264556991

6th Edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti And Hector Perera