This exercise consists of two parts. Part A. The following table summarizes the assets of the Rocker

Question:

This exercise consists of two parts.

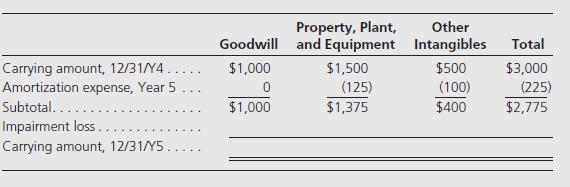

Part A. The following table summarizes the assets of the Rocker Division (a separate cash-generating unit) at December 31, Year 5, prior to testing goodwill for impairment. Property, Plant, and Equipment and Other Intangibles are amortized on a straight-line basis over an average useful life of 12 years and 5 years, respectively. Management has estimated the present value of future cash flows from operating the Rocker Division to be $1,560. No fair market value is available.

Required:

Complete the following table to determine the carrying amounts at 12/31/Y5 for the assets of the Rocker Division.

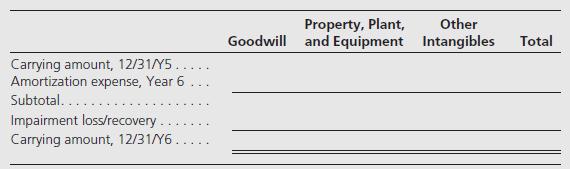

Part B. Due to favorable changes in export laws, management revises its estimate of the value in use for the Rocker Division at 12/31/Y6 to be $1,930.

Required:

Complete the following table to determine the carrying amounts at 12/31/Y6 for the assets of the Rocker Division.

Step by Step Answer: