As in Question 5, you have been asked to quantify the effects of removing an import duty;

Question:

As in Question 5, you have been asked to quantify the effects of removing an import duty;

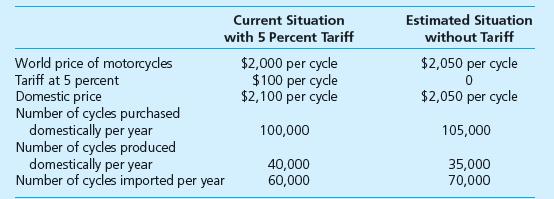

somebody has already estimated the effects on the country’s production, consumption, and imports. This time the facts are different. The import duty in question is a 5 percent tariff on imported motorcycles. You are given the information shown in the table.

Calculate the following:

a. The consumer gain from removing the duty.

b. The producer loss from removing the duty.

c. The government tariff revenue loss.

d. The net effect on the country’s well-being.

Why does the net effect on the country as a whole differ from the result in Question 5?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: