Assume a firm has the following costs: Fixed costs: $100 Marginal costs: $50/unit a. Fill in the

Question:

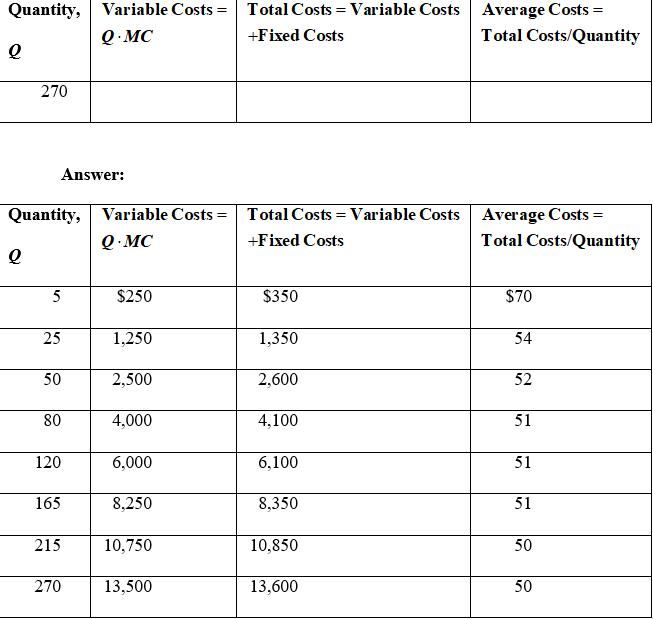

Assume a firm has the following costs:

Fixed costs: $100

Marginal costs: $50/unit

a. Fill in the missing information on the following chart:

b. At what level of output does the firm experience increasing returns to scale?

Transcribed Image Text:

Quantity, Variable Costs = Q.MC Q 5 25 50 80 120 165 215 Total Costs = Variable Costs Average Costs = Total Costs/Quantity +Fixed Costs

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 81% (11 reviews)

a Fill in the missing information on the following char...View the full answer

Answered By

Sandhya Sharma

I hold M.Sc and M.Phil degrees in mathematics from CCS University, India and also have a MS degree in information management from Asian institute of technology, Bangkok, Thailand. I have worked at a international school in Bangkok as a IT teacher. Presently, I am working from home as a online Math/Statistics tutor. I have more than 10 years of online tutoring experience. My students have always excelled in their studies.

4.90+

119+ Reviews

214+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A firm has the following investment alternatives. Each one lasts a year. The firms cost of capital is 7 percent. A and B are mutually exclusive, and B and C are mutually exclusive. a. What is the net...

-

A firm has the following short-run inverse demand and cost schedules lor a particular product: P = 45 - 0.2Q TC = 500 + 5Q a. At what price should this firm sell its product? b. If this is a...

-

Assume a firm has the following cost and revenue characteristics at its current level of output: price 5 $10.00, average variable cost 5 $8.00, and average fixed cost 5 $4.00. This firm is a....

-

What are the main technical challenges faced by firms that wish to internationalise their selection and assessment approaches?

-

The following are brief descriptions of two companies in different lines of business. A. Company A is a retailer. It makes sales on a daily basis for cash and on credit cards. B. Company B is a...

-

Define each of the following terms: a. Target payout ratio; optimal dividend policy b. Dividend irrelevance theory; bird-in-the-hand fallacy c. Information content (signaling) hypothesis; clienteles;...

-

Finally, discuss for which types of products the bookstore would do a straight rebuy and for which it would pursue a modified rebuy.

-

On July 1, 2011, Kosa, a new corporation, issued 20,000 shares of its common stock to finance a corporate Headquarters building. The building has a fair market value of $600,000 and a book value of...

-

Blossom Corporation had income from continuing operations of $755,000 (after taxes) in 2020. In addition, the following information, which has not been considered, is as follows. 1. A machine was...

-

8. Show that the differential coefficient of SP) with respect to i may be expressed 1 as: Type here to search O (1) (1+i)P.d. (i (P) 2 11C 4) ENG 00:22 2021/07/17

-

Consider a long-run model for a country producing two products (digital cameras and baskets) using two factors (capital and labor). a. Which good would you expect to be capital-intensive? Which good...

-

The following table shows the flow of FDI for select countries between 1985 and 2008. Over this period, the inflow of FDI to China increased substantially. What is the impact of this flow of capital...

-

The current price of a stock is $65.88. If dividends are expected to be $1 per share for the next five years, and the required return is 10%, then what should the price of the stock be in 5 years...

-

As of June 30, 2012, the bank statement showed an ending balance of \(\$ 13,879.85\). The unadjusted Cash account balance was \(\$ 13,483.75\). The following information is available: 1. Deposit in...

-

An engineering study has developed the following cost data for the production of product A: (1) If the current production level is 1,500 units, what is the incremental cost of producing an additional...

-

On December 1, a group of individuals formed a corporation to establish the Local, a neighborhood weekly newspaper featuring want ads of individuals and advertising of local firms. The free paper...

-

Design an arithmetic circuit with one selection variable S and two n-bit data inputs A and B. The circuit generates the following four arithmetic operations in conjunction with the input carry C in ....

-

For the system you chose for Problems and Exercises 3, complete section 4.0, A-C, Management Issues, of the BPP Report. Why might people sometimes feel that these additional steps in the project plan...

-

Give a formula for a function f that satisfies and lim f(x) = 00 lim f(x) x6 00.

-

At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a seven-year operating lease agreement. The contract calls for quarterly rent payments of $25,000 each....

-

In recent years China has been routinely accused of currency manipulation. Use The Economists Big Mac Index to investigate these claims. Go to http://www.economist.com/content/big-mac-index to access...

-

Suppose quotes for the dollareuro exchange rate E$/ are as follows: in New York $1.05 per euro, and in Tokyo $1.15 per euro. Describe how investors use arbitrage to take advantage of the difference...

-

Refer to the exchange rates given in the following table: Based on the table provided, answer the following questions: a. Compute the U.S. dollaryen exchange rate E$/ and the U.S. dollarCanadian...

-

please help Problem 13-7 (Algo) Prepare a Statement of Cash Flows [LO13-1, LO13-2] [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

-

A firm has 1000 shareholders, each of whom own $59 in shares. The firm uses $28000 to repurchase shares. What percentage of the firm did each of the remaining shareholders own before the repurchase,...

-

Vancouver Bank agrees to lend $ 180,000 to Surrey Corp. on November 1, 2020 and the company signs a six-month, 6% note maturing on May 1, 2021. Surrey Corp. follows IFRS and has a December 31 fiscal...

Study smarter with the SolutionInn App