Effective yield of portfolio. Ithaca (Greece) considers placing 30% of its excess funds in a one-year Singapore

Question:

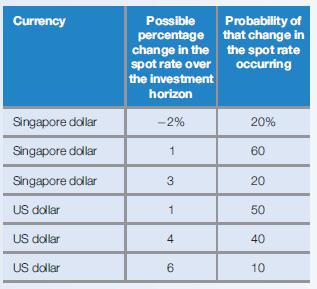

Effective yield of portfolio. Ithaca (Greece) considers placing 30% of its excess funds in a one-year Singapore dollar deposit and the remaining 70% of its funds in a one-year US dollar deposit. The Singapore one-year interest rate is 15%, while the US one-year interest rate is 10%. The possible percentage changes in the two currencies for the next year are forecasted as follows:

Given this information, determine the possible effective yields of the portfolio and the probability associated with each possible portfolio yield. Given a oneyear euro interest rate of 8%, what is the probability that the portfolio’s effective yield will be lower than the yield achieved from investing in the United States? (Assume that the movements on the two currencies are not correlated.)

Step by Step Answer: