10 Treasury management. Glass Industries Ltd manufactures glass containers for the food, drinks, and pharmaceutical industries. The...

Question:

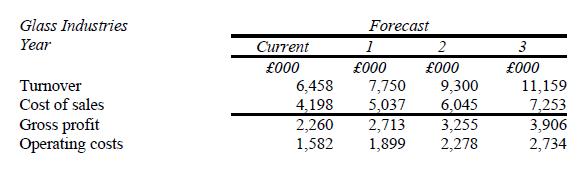

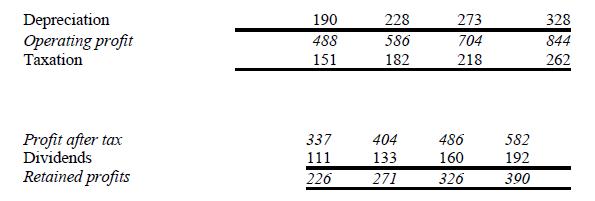

10 Treasury management. Glass Industries Ltd manufactures glass containers for the food, drinks, and pharmaceutical industries. The company’s summarised profit and loss account for the current year just ended, together with forecast profit and loss accounts for the next three years are set out below.

Currently the company is all equity financed, it has no borrowings. Management is planning to build a new production plant which will require an estimated total investment of £2.5 million, to be phased over the next three years. £1 million investment expenditure is planned for each of years 1 and 2, and the remaining £0.5 million will be spent in year 3.

The owners are reluctant to raise any long-term borrowings but are willing to arrange bank overdraft facilities to borrow up to a maximum of £500,000 on a short-term basis.

(a) As Glass Industries’ treasurer you are required, based on the financial plans as presented, to:

(i) calculate the company’s current and forecast free cash flow;

(ii) determine if it is feasible for the project to be funded within the constraints imposed by the owners.

(b) How would you define risk in the context of this investment project?

(c) What additional financial information might be helpful to decision-making in this case?

Step by Step Answer: