Assume the settlement rate in problem 2 is 618 percent. What is the solution now? Data From

Question:

Assume the settlement rate in problem 2 is 61⁄8 percent. What is the solution now?

Data From Problem 2

Transcribed Image Text:

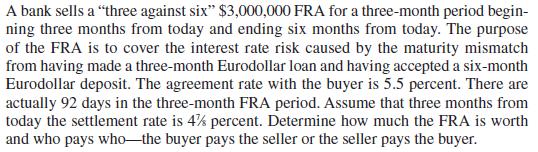

A bank sells a "three against six" $3,000,000 FRA for a three-month period begin- ning three months from today and ending six months from today. The purpose of the FRA is to cover the interest rate risk caused by the maturity mismatch from having made a three-month Eurodollar loan and having accepted a six-month Eurodollar deposit. The agreement rate with the buyer is 5.5 percent. There are actually 92 days in the three-month FRA period. Assume that three months from today the settlement rate is 4% percent. Determine how much the FRA is worth and who pays who the buyer pays the seller or the seller pays the buyer.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 14% (7 reviews)

To determine the value of the Forward Rate Agreement FRA under the new settlem...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

International Financial Management

ISBN: 9780077861605

7th Edition

Authors: Cheol Eun, Bruce Resnick

Question Posted:

Students also viewed these Business questions

-

Assume the settlement rate in problem 2 is 6.125 percent. What is the solution now? Data from Problem 2. A bank sells a three against six $3,000,000 FRA for a three-month period beginning three...

-

Assume the settlement rate in problem 2 is 61/8 percent. What is the solution now? Problem 2 A bank sells a "three against six" $3,000,000 FRA for a three-month period beginning three months from...

-

Assume your beginning debt in Problem 2 is $100,000. What amount of equity and what amount of debt would you need to issue to cover the net new financing in order to keep your debt-equity...

-

In Figure, a square of edge length 20.0 cm is formed by four spheres of masses m1 = 5.00 g, m2 = 3.00 g, m3 = 1.00 g, and m4 = 5.00 g. In unit-vector notation, what is the net gravitational force...

-

Selected comparative financial statement information of Sawgrass Corporation follows Required 1. Compute each years current ratio. (Round ratio amounts to one decimal.) 2. Express the income...

-

Declaration of a stock dividend.

-

To augment your promotion strategy from Chapter 15:

-

Construct a new version of Table 4.7, assuming that the concatenator division grows at 20%, 12%, and 6%, instead of 12%, 9%, and 6%. You will get negative early free cash flows. a. Recalculate the PV...

-

1) Selected accounts with amounts omitted are as follows Work in Process Aug. 1 Balance 260,530 Aug. 31 Goods finished 144,980 31 Direct materials X 31 Direct labor 36,500 31 Factory overhead X...

-

Calculate the amount (in grams) C7BzO surfactant would need to be added to 10mL of 7M urea, 2M thiourea so that the C7BzO concentration is 1%. This solution is referred to as UTC7 Amount of C7BzO in...

-

For each of the following lists of premises, derive the indicated conclusion and complete the justification. In problems 4 and 8 you can add any statement you choose.

-

For each of the following lists of premises, derive the indicated conclusion and complete the justification. In problems 4 and 8 you can add any statement you choose.

-

Drapers Corporation, a high-end digital camera manufacturer, currently purchases a component part from an outside company at a price of $141 per unit. While the quality of the component has always...

-

Idenfity whether the following book - tax adjustments are permanent or temporary differences. ( a ) Federal Income Tax Expense ( b ) Depreciation Expense ( c ) Accrued Compensation ( d ) Dividends...

-

2 . ) Pozycki, LLC has reported losses of $ 1 0 0 , 0 0 0 per year since its founding in 2 0 1 6 . For 2 0 2 3 , Pozycki anticipates a profit of about $ 1 0 0 , 0 0 0 . There are 3 equal members of...

-

Elena is a single taxpayer for tax year 2023. On April 1st, 2022, Elena's husband Nathan died. On July 13, 2023, Elena sold the residence that Elena and Nathan had each owed and used as their...

-

Rodriguez Corporation issues 12,000 shares of its common stock for $56,600 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The...

-

Problem 3: A large rectangular plate is loaded in such a way as to generate the unperturbed (i.e. far-field) stress field xx = Cy; yy = -C x; Oxy = 0 The plate contains a small traction-free circular...

-

The Norsk Division of Gridiron Concepts Inc. has been experiencing revenue and profit growth during the years 20Y6-20Y8. The divisional income statements follow: There are no service department...

-

Prairie Outfitters, Inc., a retailer, accepts paymnent through credit cards. During August, credit card sales amounted to $12,000. The processor charges a 3% fee. Assuming that the credit card...

-

Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago. You had invested 10,000 euros to buy Microsoft shares for $120 per share; the exchange rate...

-

Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago. You had invested 10,000 euros to buy Microsoft shares for $120 per share; the exchange rate...

-

Mr. James K. Silber, an avid international investor, just sold a share of Nestle, a Swiss firm, for SF5,080. The share was bought for SF4,600 a year ago. The exchange rate is SF1.60 per U.S. dollar...

-

Comfort Golf Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Stenback Inc. costs $1,000,000 and will last five years and have...

-

Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 71,000 shares of $10 par common stock. 8,500 shares of $60 par, 6 percent, noncumulative preferred stock. On...

-

Read the following case and then answer questions On 1 January 2016 a company purchased a machine at a cost of $3,000. Its useful life is estimated to be 10 years and then it has a residual value of...

Study smarter with the SolutionInn App